|

(The Federation of Korean Industries) |

South Korean companies, many of them in the manufacturing industry, face bigger environmental, social and corporate governance risks than their service-heavy European counterparts, the Federation of Korean Industries warned on Sunday.

Compared to companies located in countries like France or the UK, those based in South Korea, China, and India are more vulnerable to risks stemming from global ESG trends, the FKI said in a report.

ESG first gained traction among risk-conscious investors and are now fast becoming a new guiding principle for sustainable corporate management.

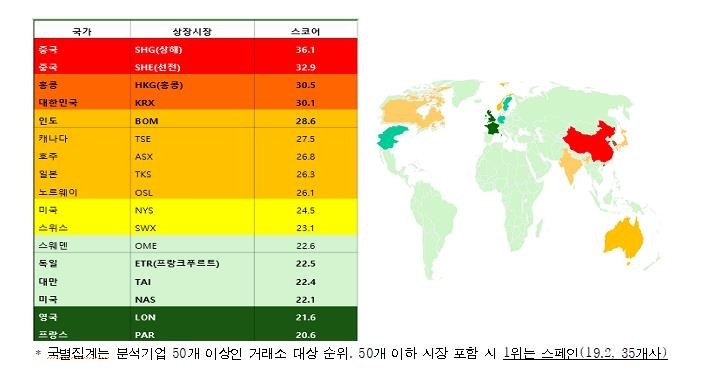

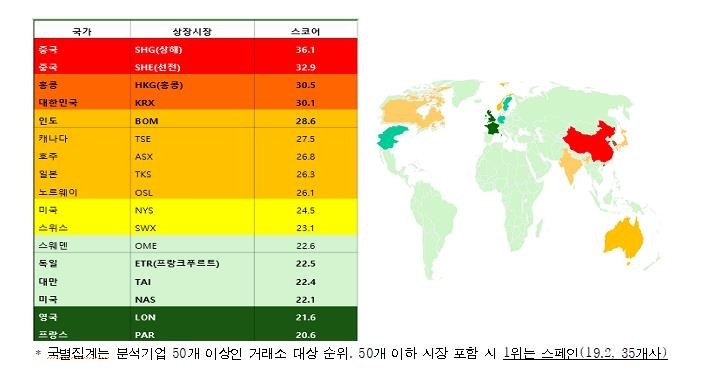

The markets with some of the highest average ESG risk rates included the Shanghai Stock Exchange, the Shenzhen Stock Exchange, the Stock Exchange of Hong Kong and Korea Exchange, the federation said. The analysis is based on data from Sustainalytics, a company that rates the sustainability of listed companies.

In stark contrast, Euronext Paris, London Stock Exchange and Nasdaq had some of the lowest ESG risk rates on average.

Countries with lower ESG risks tend to have a bigger service industry while those with higher ESG risks tend to have bigger manufacturing industries, the report said.

The service industry each accounted for some 80 percent of France and the UK’s economy, according to recent data from the Industrial Statistics Analysis System.

The figure, however, was 62.4 percent for South Korea and 53.4 percent for China.

When broken down by sector, steel and metal manufacturing as well as oil and gas industries scored high on the risk list while clothing, media and retail sectors faced a lower risk.

Samsung Electro-Mechanics, NCSoft, CJ ENM, Naver and Fila Holdings were among the South Korean companies with a lower ESG risk named in the report.

Tokyo Electric Power Co., which announced the decision to dump radiation-contaminated water from the Fukushima Dai-ichi Nuclear Power Plant earlier this year, was listed among the top five high-risk companies globally.

With each sector being subject to a different set of standards when it comes to ESG risk assessments, the FKI said it is imperative that companies focus on issues that affect them the most.

“(Companies) should standardize ESG risk-related issues in advance in order to lower the chances of it happening and also prepare a process or governance that can react quickly when risks materialize,” the federation said.

By Yim Hyun-su (

hyunsu@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)