|

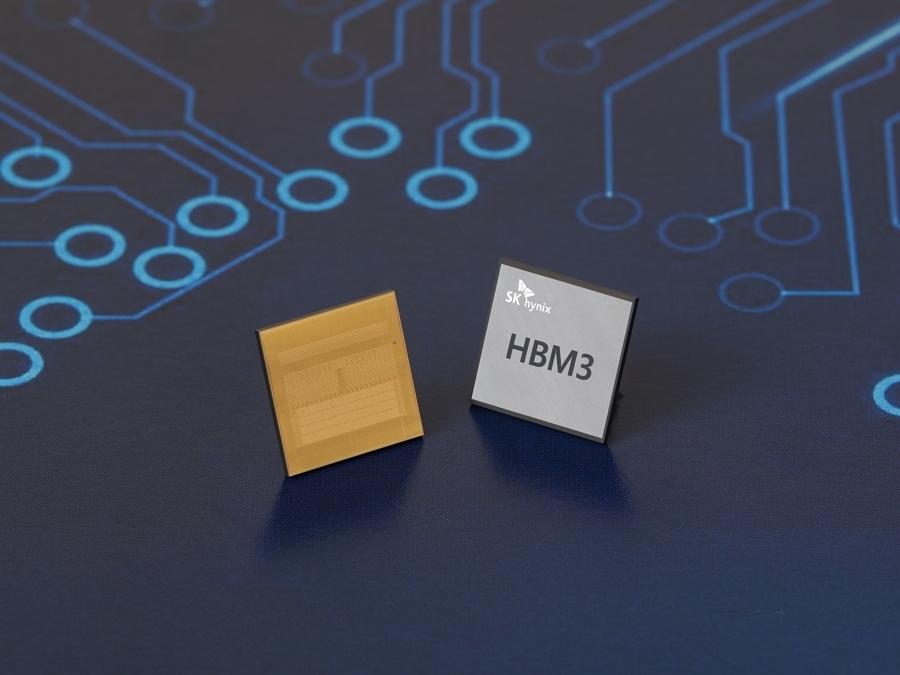

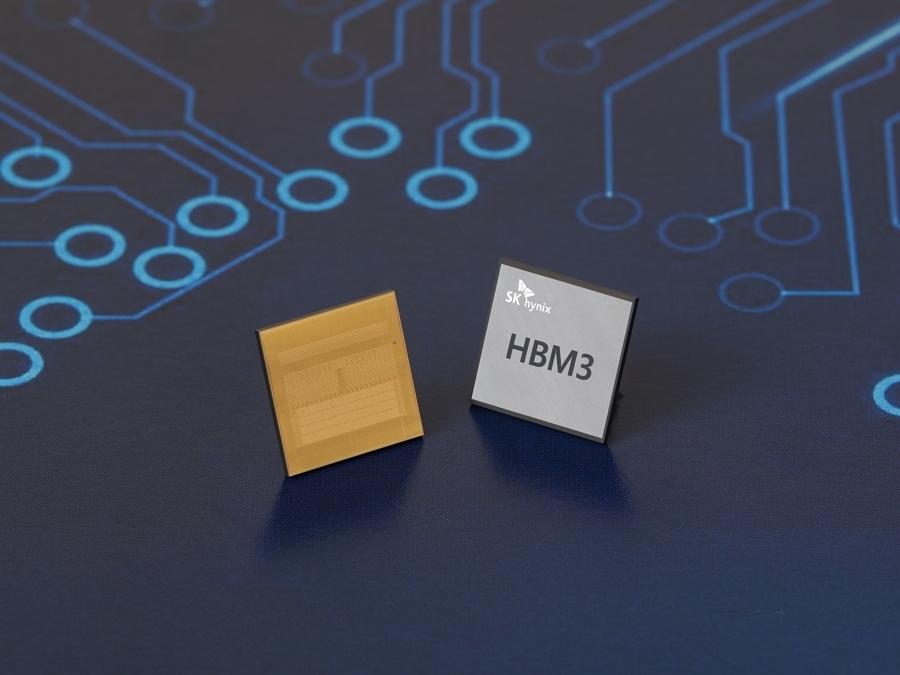

HBM3 (SK Hynix) |

SK hynix Inc., South Korea's No. 2 chipmaker, reported strong third-quarter earnings Tuesday on the back of solid memory chip demand and rising prices.

Net profit for the three months that ended in September leaped by 205.7 percent from a year earlier to 3.31 trillion won ($2.8 billion).

Operating profit came to 4.17 trillion won, the highest since the fourth quarter of 2018. Sales increased 45.2 percent to a record of 11.8 trillion won during the same period, marking the second consecutive quarter that the company logged more than 10 trillion won in sales.

Demand for consumer products and servers continued to spur earnings growth.

SK hynix, the world's second-largest DRAM maker behind Samsung Electronics Co., expects the favorable market conditions to continue for the rest of the year, spurred on by seasonal demand.

But a gloomy forecast for the memory market is lowering expectations for SK hynix, which heavily depends on memory chips, like DRAM and NAND.

DRAM and NAND account for more than 90 percent of SK hynix's revenue. The company is the world's second-largest DRAM supplier behind Samsung Electronics Co. and the No. 4 vendor in the global NAND market, according to industry tracker TrendForce.

The research firm warned DRAM prices will fall by 15 to 20 percent annually in the fourth quarter and enter a downward trend early next year, as the supply is expected to outstrip demand.

"DRAM contract prices are likely to exit a bullish period that lasted three quarters and be on the downswing," it said in a report released earlier this month.

"This decline can be attributed to not only the declining procurement activities of DRAM buyers going forward but also the drop in DRAM spot prices ahead of contract prices," it added. (Yonhap)