The US dollar has been at the center of the global monetary system for more than seven decades since the end of World War II. The dollar-dominated international monetary system has shaped the postwar world political economy by significantly contributing to US power, both economically and politically, as well as lubricating the wheels of the global economy. However, in recent years there have been some notable growing developments that might shake the dollar’s global supremacy.

China has been endeavoring to promote the international use of its own currency, the renminbi, since the outbreak of the global financial crisis of 2008. Cryptocurrencies such as Bitcoin have also grown considerably, with their aggregate market capitalization reaching almost $3 trillion last November, a staggering jump from a mere $14 billion five years ago. The growth of stablecoins is likewise remarkable, as shown by the rise of Tether’s market capitalization from around $4 billion in January 2020 to $80 billion this month.

Meanwhile, the majority of central banks are currently exploring central bank digital currencies, with China at the forefront among major economies, already piloting a digital renminbi with a large population. Will these new monetary developments challenge the current dollar-led global monetary order and transform the monetary map of the world? This is undoubtedly one of the most salient questions for the future of the global political economy, given that such developments could affect the state’s capacity to manage its economy, the operation of the world economy and the distribution of power in the globe.

Two experts joined a discussion on if a new monetary world is emerging.

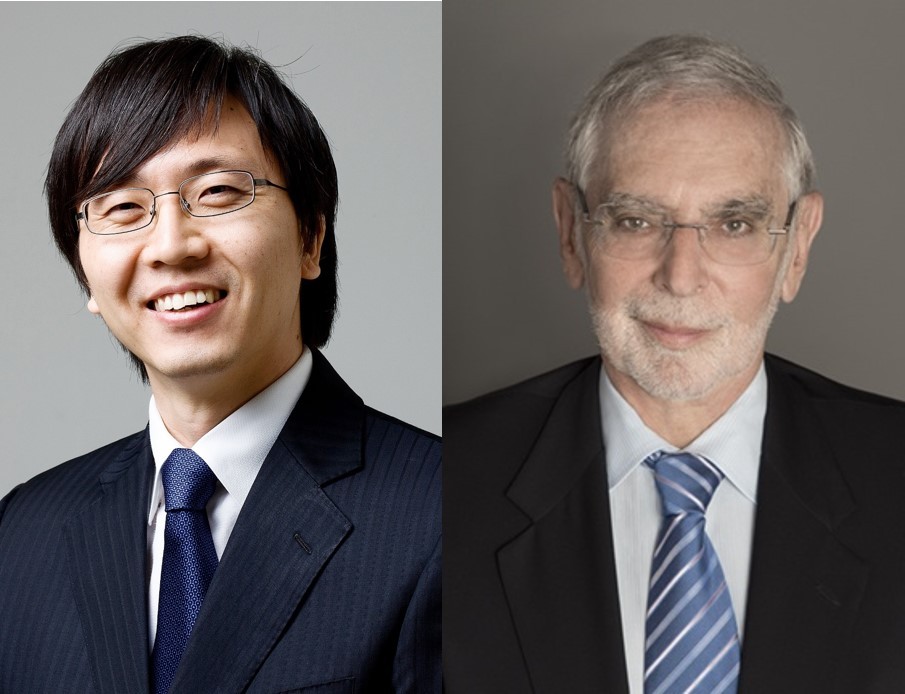

First is Benjamin J. Cohen, a distinguished professor emeritus at the University of California, Santa Barbara. He is a prominent specialist in the political economy of international money and finance, and also is the author of 18 books, including most recently “Currency Statecraft: Monetary Rivalry and Geopolitical Ambition” (2019) and “Rethinking International Political Economy” (2022).

Hyoung-kyu Chey is an associate professor of international political economy at the National Graduate Institute for Policy Studies in Tokyo. Prior to joining the institute, he worked as an economist in the Economic Research Institute at the Bank of Korea. His new book “The International Political Economy of the Renminbi‘’ was published by Routledge last November.

Hwang: Do you think that the current dollar-centered global monetary system will face significant challenges in the coming years?

Cohen: There will no doubt be challenges. The question is: How significant will they be?

The US dollar’s central role was formalized in the Bretton Woods agreement of 1944. But almost immediately the greenback came under pressure, as US liabilities grew to exceed the supply of gold stored away in Fort Knox. The demise of the dollar-based system has been predicted ever since.

Two challenges stand out.

Some observers anticipate the rise of powerful alternatives to America’s currency, such as the euro or the renminbi. Every international money in history has ultimately met its match and gone into decline. Why not the greenback, too?

Others point to America’s persistently growing debt, which jeopardizes US financial credibility. Once the world’s largest creditor nation, the United States now is history’s greatest debtor. Sooner or later, many fear, this massive “overhang” of debt could shake the market’s faith in the dollar.

Chey: There are certainly challenges to the dollar emerging.

They include both internal challenges, such as the recently growing inflationary pressures in the United States, and external ones like the efforts of some states including China and Russia to build nondollar international payment systems.

That being said, I think that overall the greenback’s global supremacy is likely to remain solid for quite a while, given the many critical incomparable advantages over other currencies that it holds, including the depth and liquidity of the US Treasury market and the US supremacy in military power, a very important ultimate source of confidence in the dollar.

In short, there is at this moment no visible strong currency to rival the dollar.

Hwang: How do you assess the internationalization of the Chinese renminbi over the past years?

Cohen: The renminbi (RMB) has not lived up to expectations; nor do I expect it to do any better in the years to come.

Fifteen or so years ago, when the RMB first emerged on the world stage, a bright future for it was predicted by many. China was on its way to become the largest economy in the world, as well as No. 1 in trade. So why shouldn’t the RMB surpass the dollar as well?

Yet in actual practice China’s currency has made little headway, accounting for less than 3 percent of turnover in the foreign-exchange market (against 45 percent for the dollar) and no more than 4 percent of global monetary reserves (against 60 percent for the dollar).

The biggest problem is China’s Great Wall of capital controls, which discourage foreign investors and central banks alike. So long as Beijing resists opening its financial markets, the appeal of the RMB will be limited.

Chey: Despite the considerable efforts by Beijing to promote renminbi internationalization, its actual progress does not match many early rosy forecasts for it. Since reaching a peak in mid-2015, the renminbi’s internationalization has retreated somewhat and remains largely stagnant.

That being said, there are some noteworthy signs that have positive implications for it.

The renminbi’s global share as a reserve currency has continued to grow until now, albeit gradually. Moreover, its use as a global payment currency has begun to rebound since late last year, and it has overtaken the Japanese yen again.

The saga of renminbi internationalization is still ongoing.

Hwang: Do you think that the introduction of a digital renminbi will lead to a significant increase in the renminbi’s international use?

Chey: Beijing is exploring how a digital renminbi can be used for cross-border payments, working with Hong Kong, Thailand and the United Arab Emirates on a project to build a multiple central bank digital currency platform for international payments. In this regard, one key issue is achieving technical interoperability across central bank digital currencies. It should also be noted, meanwhile, that a digital renminbi is essentially still the renminbi. Therefore, even if the technical hurdles to its international use are fully overcome, the currency’s internationalization may still not increase significantly without resolution of the renminbi’s major disadvantages as an international currency, including the limited capital account convertibility in China, the underdevelopment of the Chinese financial markets and the nation’s authoritarian political regime.

Cohen: The answer will depend on what other governments do. Other things remaining the same, a digital RMB would enhance the appeal of China’s currency for payments and other purposes.

International use of the RMB would certainly be encouraged. But other things are unlikely to remain the same.

Digitalization will surely be pursued by other monetary authorities as well -- most notably, by major actors like the Federal Reserve and European Central Bank -- largely neutralizing any advantage the RMB might have as a first-mover. And of course there will also be many privately issued digital currencies out there adding even more to the competition.

In this context, China’s renminbi will not enjoy any special advantage.

Hwang: Will the launch of a digital renminbi pose a substantial threat to the United States or the dollar?

Cohen: My answer here is much the same as my answer to your previous question.

Digitalization is attractive to market actors because it offers the promise of anonymity as well as fast and efficient settlement of transactions. In effect, it represents an updated, modern equivalent of cash. In the absence of any reciprocal initiative by the Federal Reserve, a digital RMB could indeed pose a significant competitive threat to the dollar.

But as I suggested, I do not expect Washington to sit quietly on its hands. Quite the opposite, in fact.

The Fed recently issued a research paper outlining the advantages and disadvantages of digitalization -- the first step toward a digital dollar, which I am sure will come into force in the next few years. A principal motivation will be to ensure that any early advantage enjoyed by a digitalized RMB will be temporary at best.

Chey: Since the mere digitization of the renminbi will not necessarily lead to substantial growth in its internationalization, the digital renminbi will not necessarily threaten the dollar’s global supremacy either.

However, if it helps China to construct an international renminbi payment system, especially with countries burdened by US financial sanctions such as Russia and North Korea, it could be utilized as a conduit enabling them to circumvent those sanctions, and accordingly undermine Washington’s capacity to achieve its foreign policy goals.

But this impact will be limited given the US implementation of “secondary sanctions” also, as long as the dollar retains its status as the dominant international currency.

Hwang: Do you think the international standing of the euro can ascend further in the future?

Chey: The euro area has traditionally maintained a neutral stance toward the euro’s internationalization. Recently, however, European discontent with the dollar’s dominance has grown, due largely to the Trump administration’s “America First” policy and its imposition of “secondary sanctions,” which have coerced European firms to comply with the US primary sanctions.

As a result, the eurozone does now have the will to promote the euro’s international roles. But the euro’s chief weaknesses, such as the absence of a central political authority in the eurozone and the fragmentation of the euro capital market, remain largely unchanged. They will likely hinder any substantial further internationalization of the common currency.

Cohen: Today, the euro stands as the world’s second-most-important international currency, but is still far behind the dollar. It is best understood as a regional money, used mainly by countries in Europe and parts of Africa but not much beyond.

Many Europeans would like to see the currency rise in standing. But that is unlikely to happen for two reasons.

First, the center of gravity of the world economy is shifting to Asia, where the euro is less useful. And second, the appeal of the currency -- particularly as an investment medium or reserve asset -- will remain limited so long as there is no genuine fiscal and banking unification among the euro zone’s 19 sovereign members.

The monetary union offers nothing so attractive as the vast market for US Treasury obligations and other dollar-denominated claims.

Hwang: Do you see more promise or peril from Bitcoin and other cryptocurrencies?

Cohen: Cryptocurrencies offer both promise and peril. On the positive side, as I have said, they offer the promise of anonymity as well as the possibility of speedy and efficient settlement of transactions. Through so-called “blockchain technology,” market actors have access to decentralized payments systems that are independent of both governments and private banks. But there are also three major dangers.

First, competition among cybercurrencies could lead to greater risk-taking by their sponsors, leading to the modern equivalent of old-fashioned “bank runs.” Second, as Bitcoin demonstrates, there is a risk of unrestrained price volatility, limiting the usefulness of cybercurrencies as a medium of exchange. And third, there is the possibility of a real threat to state authority in monetary affairs, threatening macroeconomic instability.

Chey: The blockchain technology underlying cryptocurrencies appears to benefit global finance in various ways.

The benefits of cryptocurrencies themselves are more questionable, however. Despite their spectacular growth in popularity as virtual assets, the use of cryptocurrencies as money is still extremely marginal, owing largely to the roller-coaster volatility in their prices, which hinders the establishment of confidence in them.

Moreover, in the case of Bitcoin, the so-called “king crypto,” transaction fees have risen significantly, weakening its advantage as a means of cross-border payments or overseas remittances.

At present the use of cryptocurrencies appears to be limited largely to transactions in them as speculative assets, or for illicit financial activities. This may not be the world that crypto enthusiasts have envisioned.

Hwang: Do you think that the use of cryptocurrencies will grow significantly?

Cohen: Yes, I do. Demand for cryptocurrencies is bound to grow precisely because of the advantages offered -- anonymity and the possibility of lower-cost payments networks. In response, cryptocurrencies are multiplying like rabbits.

My feeling is that for now we are in the equivalent of a “bubble” -- a frenzy of experimentation and risk-taking -- that is going to end badly for many.

In reality, cryptocurrencies have come to serve primarily as a vehicle for risk-loving investors. But eventually, with consolidation and the introduction of proper public supervision, the market for cryptocurrencies is likely to settle down just as similar eruptions of financial innovation have done in the past.

There is no reason why privately issued cryptocurrencies cannot function efficiently alongside central bank digital currencies, just as Mastercard and Visa credit cards function alongside cash today.

Chey: The wild fluctuation in cryptocurrencies’ prices is attributable primarily to one of their core attributes: the absence of a central authority that manages and protects their values. Therefore, the feasibility of cryptocurrencies ascending as major money is not likely to be high.

It is of course true that mainstream investors have recently begun to include crypto in their portfolios, and a growing number of major financial institutions offer crypto-related financial services. And these developments may heighten their use as assets. But, unlike other assets, cryptocurrencies have no intrinsic value at all. There may thus be a possibility of their markets collapsing when a big shock occurs.

Hwang: How about stablecoins? Will their use grow? How will they affect the global monetary system?

Cohen: Stablecoins are simply one species of cryptocurrency.

The earliest cryptocurrencies -- beginning with Bitcoin, the granddaddy of all cryptocurrencies -- were backed by little more than flimsy promises. Trust was supposed to be cultivated by delegating verification to a public consensus mechanism managed through a peer-to-peer network that alerts participants to every transaction in real time.

For some, that was not enough.

Thus stablecoins like Tether or USD Coin were introduced, intended to reinforce trust by promising full backing with conventional reserves. Unfortunately many stablecoins are quite lacking in transparency, increasing their risk and so limiting their appeal. That is why I suggest the need for proper public supervision, to assure that backing will indeed be adequate.

Chey: In contrast to traditional cryptocurrencies such as Bitcoin, the values of stablecoins are pegged to other assets, such as the dollar, and are accordingly supposed to be “stable.” This is a great allure of stablecoins, and they have in fact grown remarkably during the pandemic, in terms of both market capitalization and trading volume.

However, their actual redeemabilities have been called into question, as shown in the case of Tether, the largest stablecoin, which overstated its reserves. They can also face liquidity problems. Therefore, stablecoins carry with them significant potential risks to financial stability.

Hwang: Besides China, a large number of other countries are also considering introducing central bank digital currencies. How do you think they will affect the global financial system?

Chey: Central bank digital currencies will likely become public digital money having more safety, more resilience and greater availability than cryptocurrencies, which are private digital money. They have strong potential to enhance financial inclusion, to make possible more efficient financial services, and to strengthen their governments’ capacities to manage the economy.

They may open a new chapter in the history of money.

However, it is also true that CBDCs involve notable latent risks, including the possibilities of their becoming “panopticons” to monitor and control citizens. How to balance the pros and cons of central bank digital currencies must therefore be carefully considered.

Cohen: As I suggested earlier, I fully expect that many monetary authorities will pursue digitalization. Those central banks that do introduce their own version of a cryptocurrency will enjoy an advantage relative to those who lag behind.

Being backed by the “full faith and credit” of their sovereign governments, they will also enjoy an advantage relative to privately issued cryptocurrencies.

My guess is that eventually most if not all central banks will join the game, if only to defend their own currencies against encroachments by others. In turn, a network of central bank digital currencies will provide the infrastructure for a global payments system that could be much cheaper and swifter than anything we have seen until now

Hwang: There are voices saying that the United States should issue a digital dollar to defend the dollar’s global status. Do you agree?

Cohen: Yes, I most certainly agree. As I have already noted, the dollar faces serious challenges – not least, the possible rise of powerful alternatives. The threat to the greenback will grow to the extent that other major central banks succeed in introducing a genuinely attractive digital currency.

If the greenback’s long dominance of the global system is to be sustained, Washington will have no choice but to counter with a digital version of its own beloved greenback. Otherwise, decline beckons. If monetary history teaches us anything, it is that international currencies like the dollar may flourish for a long time.

But they do not last forever.

Chey: The US decision on whether to issue a digital dollar will obviously depend upon whether Washington assesses this to be in its own interests.

While neither cryptocurrencies nor a digital renminbi are likely to challenge dollar supremacy immediately, they could cause some crack in the current dollar-centered international financial system, by facilitating the creation of nondollar international payment networks for some countries as I mentioned earlier.

It seems that concerns about such geopolitical and financial risks have grown in Washington recently, as shown by President Biden’s March 9 executive order that includes strong support for exploring the idea of a digital dollar.

---

Hwang Jae-ho is a professor of the division of international studies at the Hankuk University of Foreign Studies. He is also the director of the Institute for Global Strategy and Cooperation and a current member of the Presidential Committee on Policy and Planning. This discussion was assisted by researchers Ko Sung-hwah and Shin Eui-chan.By Choi He-suk (

cheesuk@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)