|

SsangYong Motor’s headquarters in Pyeongtaek, Gyeonggi Province. (SsangYong Motor) |

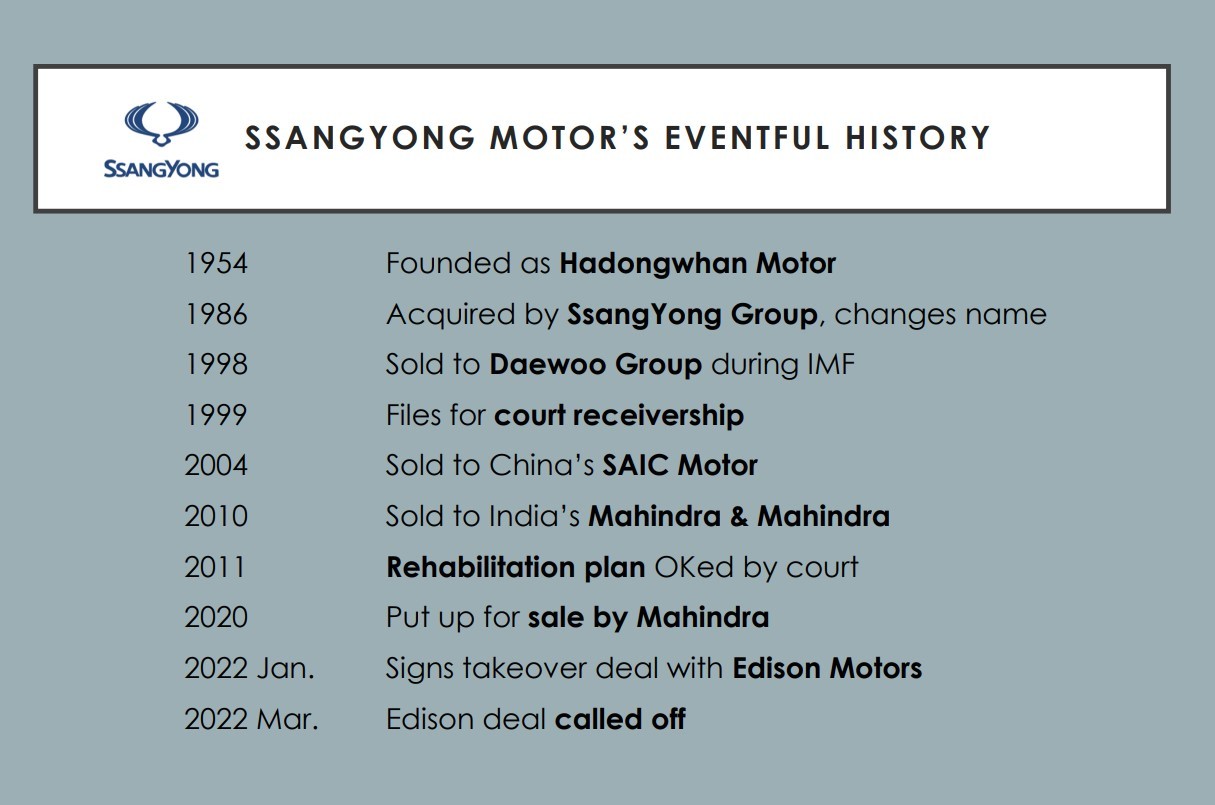

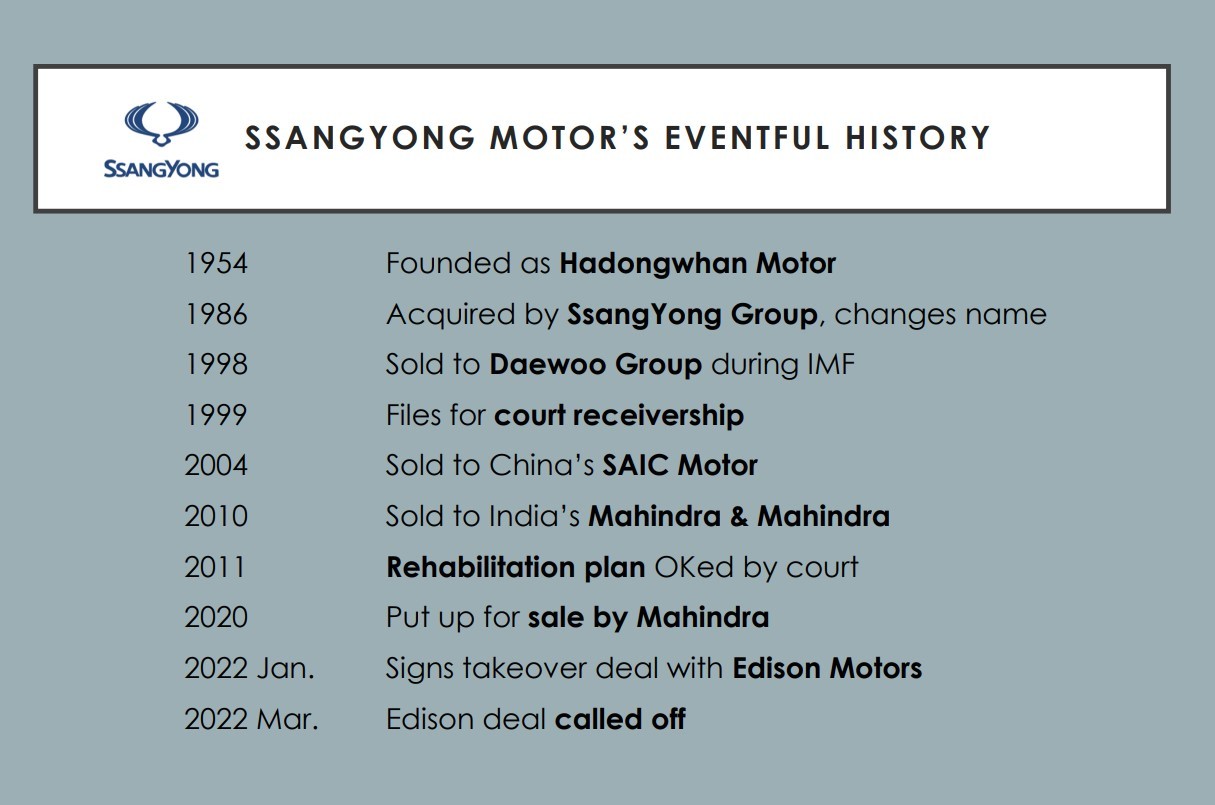

Ssangbangwool Group, best known for its underwear business, is joining an estimated 1 trillion won ($819 million) bidding war to acquire debt-ridden carmaker SsangYong Motor whose takeover deal with Edison Motors has recently been called off.

Ssangbangwool, or SBW, plans to turn in a letter of intent this week to the lead manager of the deal, EY Hanyoung, by forming a consortium led by subsidiary Kanglim, a maker of special-purpose vehicles like firetrucks and cranes.

Other than Kanglim, SBW’s other affiliates such as entertainment company IOK and optical component manufacturer Nanos are also expected to join the consortium.

The latest bid for SsangYong Motor comes after a Kanglim-led consortium’s failed attempt to acquire budget airliner Eastar Jet, worth 120 billion won, last year.

Industry watchers say considering Kanglim’s expertise in the vehicle renovation business as well as its investment in electric powertrains with US startup Ridecell, it could create synergies with SsangYong if the acquisition goes through.

But the issue is its capability to secure enough funds, estimated at 1 trillion won, to pay back SsangYong’s 700 billion-won debt as well as normalizing the carmaker’s business operations for sustainable growth.

Last year, SBW’s seven affiliates recorded a combined 630 billion won in sales. SsangYong Motor logged 1.2 trillion won in sales during the same period.

Kanglim, among others, may have continued posting upbeat sales in recent years but it has yet to turn to profit. Its net loss more than tripled from 6 billion won in 2019 to 23 billion won last year.

“We have 120 billion won in cash that had been secured for the Eastar Jet takeover. We have discussed internally over our funding capability and concluded that we have no issue with it,” said an official from SBW Group.

Last year when SsangYong Motor announced a notice of tender, 10 bidders turned in letters of intent for a takeover, but only three of them participated in the actual bidding, mainly due to funding issues.

SsangYong’s talks with Edison also fell apart after the bidder failed to pay the initial 300 billion won by the deadline. Observers didn’t rule out the possibility of the same happening again to SBW.

“Not only to cancel SsangYong’s massive debt but also for the future growth, the carmaker requires a large-scale investment to develop future technologies like electric vehicles and autonomous driving,” an industry source said on condition of anonymity.

|

(Kim Da-sol/The Korea Herald) |

Another major hurdle is the deal’s tight schedule.

After SsangYong filed for court receivership in December 2020 and signed a memorandum of understanding for a takeover deal with Edison in November 2021, the Seoul Bankruptcy Court set the approval deadline for rehabilitation plans by Oct. 15 this year.

That is, SsangYong needs to find a new owner in six months and turn in the new plan to get approval.

Considering that it took about a year for SsangYong Motor to post the tender notice in May 2010 after finalizing the takeover deal with India’s Mahindra to get the court’s approval to end the court receivership, some say it is not impossible for SBW Group to push ahead with the acquisition before the deadline.

For the most recent M&A process with Edison Motors, it took eight months from signing the contract to apply for the court’s review with a full balance payment deadline.

Meanwhile, the midsize electric vehicle maker Edison Motors said it has filed for an injunction to cancel SsangYong’s notification of the end of the takeover deal, arguing that it has received a court approval to delay the payment due date and the contract termination from SsangYong was “one-way.”

As Edison Motors, which continues to argue that it has enough capital to pay the remaining balance of some 300 billion won, said it will push ahead with the SsangYong acquisition, the M&A process with Kanglim-led consortium is bound to face a rocky road ahead.

An official from SBW Group said the company is willing to discuss with Edison Motors and collaborate, if necessary.

By Kim Da-sol (

ddd@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)