|

A bird's eye view of Samsung Electronics chip manufacturing plant in Hwaseong, Gyeonggi Province. (Samsung Electronics) |

South Korea's chip manufacturing industry is facing the worst crisis in a decade, a survey that polled semiconductor experts showed Monday.

Twenty-four out of the 30 chip experts surveyed by lobby group Korea Chamber of Commerce and Industry responded that Korea is either facing the threat as grave as, or graver than, Chinese chipmakers' foray into memory chip business in 2016 or the trade war between the United States and China in 2019.

Of the respondents, 13 said Korea's situation is worse than those two low points, while 11 answered that Korea's current threat is as serious.

The warning comes as mobile tech giant Apple approved China-based Yangtze Memory Technologies as a vendor of third-dimensional NAND flash memory chips on its newest flagship smartphone iPhone 14 beginning later in September, a development that could pose a threat to Korean memory chip giants like Samsung Electronics and SK hynix.

|

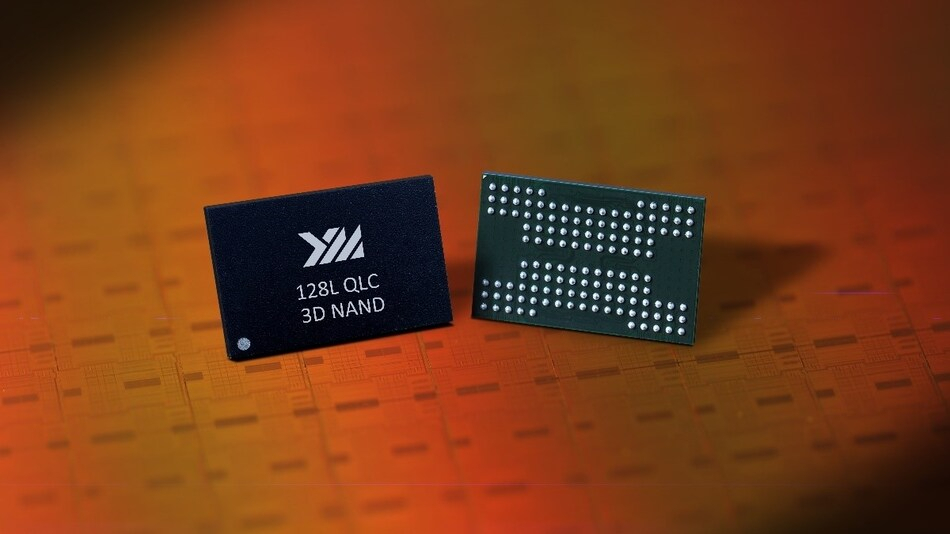

An image of YMTC's 128-layer NAND Flash memory (YMTC) |

Combined with industrywide risks like memory chip oversupply, price cuts and the resulting decline in monthly chip exports for the first time in 26 months in August, the increasing competition posed by Chinese entities is stoking fears of a domestic chip industry downturn that could last more than two years. The KCCI survey showed that nearly 60 percent of experts said the chip industry crisis is likely to persist for at least the next two years.

"Uncertainties in the Korean chip industry in the past have been mostly short-lived, as the problems stemmed from transient external challenges or regular chip down cycles," Burm Jin-wook, professor of electronic engineering at Sogang University, was quoted as saying by the KCCI.

"Now, intensifying global competitions in the chip supply chain that show no signs of abating, combined with the fears that Chinese followers are evolving fast, are leaving chipmakers in Korea more nervous than ever."

As to whether Korean chipmakers are facing a crisis or not, only one out of 30 responded that Korea's industry is not facing a crisis.

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)