|

Samsung Biologics President and CEO John Rim speaks during a press conference held at a hotel in Boston, Massachusetts, on Monday. (Samsung Biologics) |

BOSTON, Massachusetts -- South Korean biologics contract manufacturer Samsung Biologics will make another huge step forward by shortening the construction time for its new manufacturing facility with an annual production capacity of 180,000 liters by five months to meet the growing demand from its clients in the pharmaceutical industry, the firm’s CEO, John Rim, said Monday.

The Korean firm has now secured as clients 13 of the top 20 global pharmaceutical companies, including GlaxoSmithKline, Pfizer Ireland Pharmaceuticals and Eli Lilly. Back in 2011, the number was a mere three.

“The company has entered a stable growth trajectory as the number of large-scale, long-term contracts with Big Pharma clients have increased,” Rim said during a press conference held on Monday on the sidelines of the 2023 BIO International Convention, which took place in Boston, Massachusetts June 5-8.

This year, the company continued to receive new orders and expand existing contracts, exceeding 750 billion won ($573.8 million) in accumulated orders as of June.

On Sunday, Samsung Biologics said it has signed a $112.5 million contract manufacturing organization letter of intent with an unnamed US biopharmaceutical firm. The amount accounted for 4.91 percent of the company's total sales in 2022. On the same day, it also announced that it would extend the existing contract period with Roche for another three years.

To meet such demand, the company’s Plant 5, with a manufacturing capacity of 180,000 liters in Songdo, Incheon, will commence operations in April 2025, moving up its initially announced schedule by five months.

"The decision for early operation was a preemptive response to growing CDMO demand and a response to the new contracts and increased volume of existing contracts," he said.

“The estimated construction period for Plant 5 is 24 months, as it broke the ground in April 2023, setting a new record, about 1 year shorter than Plant 3, which holds the same capacity and took 24 months to go online,” Rim said.

Rim attributed the drastically shortened the construction period for the new manufacturing facility to “accumulated factory construction know-how." “There is now a collection of best practices in the process of constructing four plants over the past 10 years," he said.

Upon Plant 5’s full completion, Samsung Biologics will maintain its global leadership in biomanufacturing capacity with a total of 784,000 liters.

“By applying specific designs developed by Samsung in the plant, we will increase production efficiency to the world's highest level, and operational efficiency will be optimized by expanding the application of automation technology,” he said.

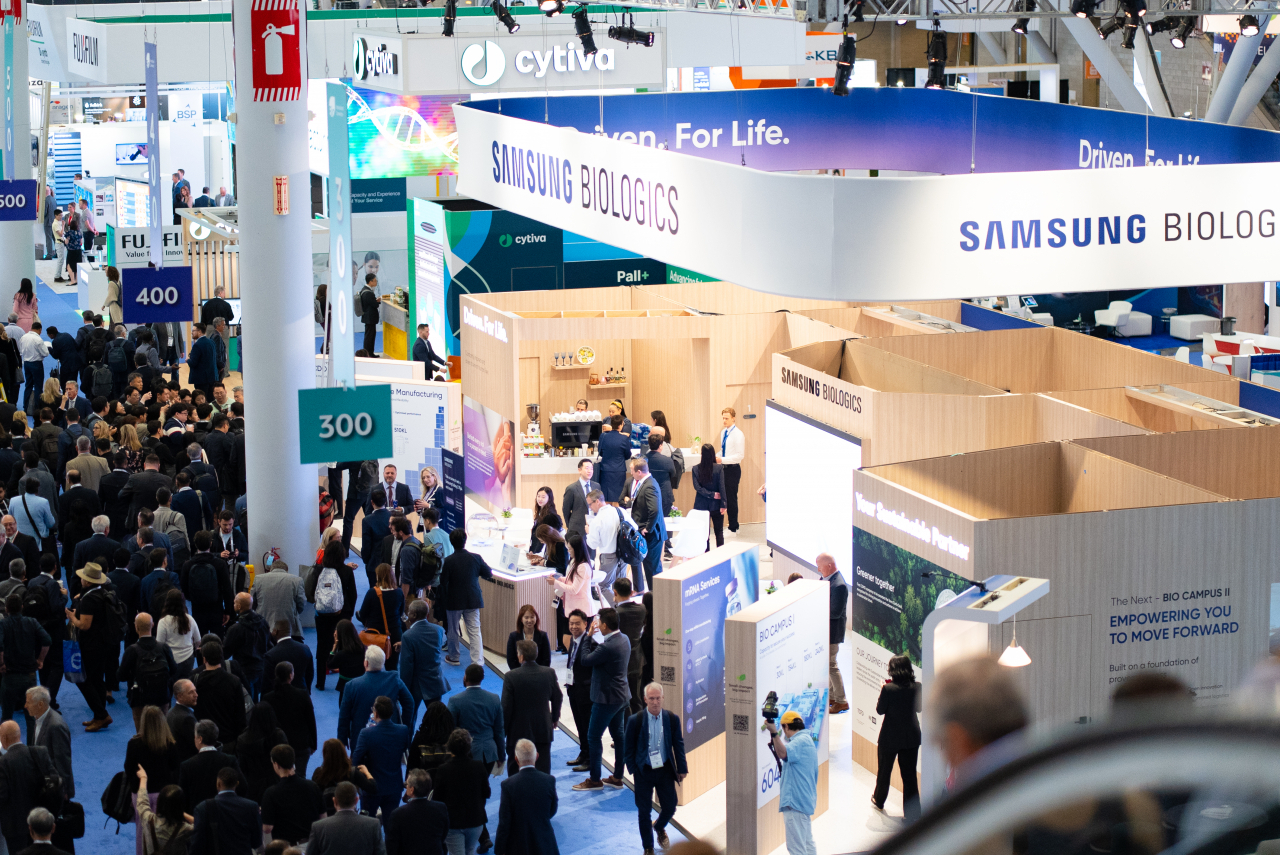

|

Samsung Biologics' exhibition booth set up for the 2023 Bio International Convention, which kicked off in Boston, Massachusetts, on Monday. (Samsung Biologics) |

Its Plant 4, the world's largest single pharmaceutical plant with a total capacity of 240,000 liters, became fully operational in July of this year. As a result of the shortened construction period and focusing on preorders at the same time, “We have currently signed production contracts with 9 clients for 12 products and are in the process of discussing contracts for 44 products with 29 clients,” the CEO said.

Launching a regional office in New Jersey in March was a strategic move that the company made this year to work in closer proximity to both existing and potent clients based in the US and Europe, he added.

Rim said the company would build a production plant exclusively for antibody-drug conjugate biopharmaceuticals in order to respond preemptively to the ADC market that has been attracting growing attention recently. ADCs refer to the class of drugs mainly designed to be targeted therapy for treating cancer.

Its investment into ADC technologies is not limited to production facilities. Samsung Biologics is also seeking to "strengthen the competitiveness of production technology." Its recent investment in Araris Biotech AG, a Swiss-based biopharmaceutical company that develops ADC therapies and owns proprietary ADC linker technology, was a part of such efforts, he said. The investment was made through Samsung Life Science Fund, established by Samsung C&T Corp. and Samsung Biologics.

The global ADC market size was $4 billion in 2021 and is predicted to grow at a compound annual growth rate of 14.12 percent to reach $13.13 billion by 2030, according to Evaluate Pharma.

Synergies between Samsung Biologics and its subsidiary, Samsung Bioepis, are expected to materialize in earnest as the latter’s biosimilar portfolio expands this year.

Samsung Bioepis plans to launch Hadlima, a biosimilar referencing AbbVie’s blockbuster drug, Humira, used to treat rheumatoid arthritis, Crohn's disease, ulcerative colitis and other conditions, in the US market in July.

The size of the Humira biosimilar market was about 27 trillion won in 2022.

The subsidiary is seeking to hit the European market with Epysqli, a biosimilar of Soliris, a drug for the treatment of adult and children patients with paroxysmal nocturnal hemoglobinuria, after receiving marketing authorization from the European Commission in May.

Samsung Bioepis now has seven biosimilars on the European market, including Epysqli.