|

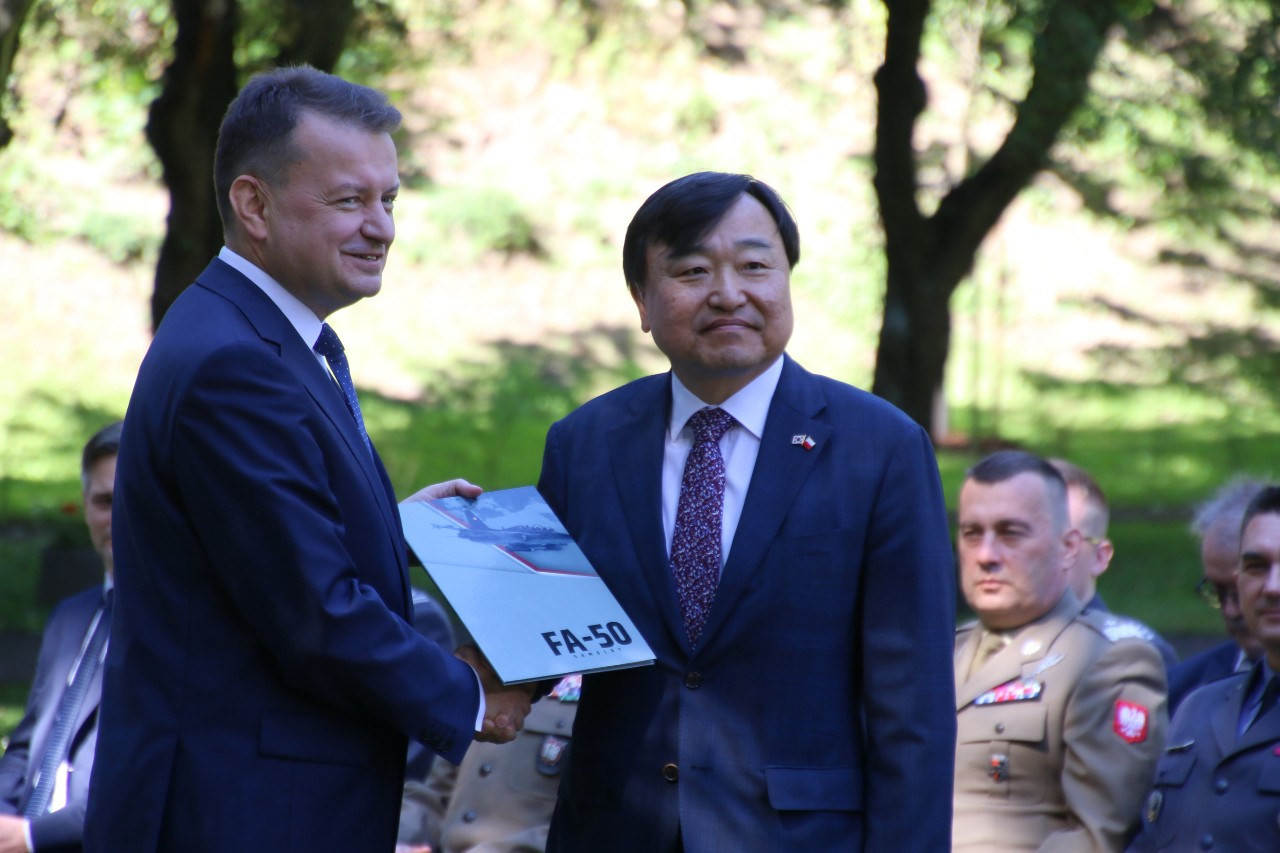

Polish Deputy Prime Minister and Defense Minister Mariusz Blaszczak (left) and Korea Aerospace Industries CEO Ahn Hyun-ho pose for a photo after signing a contract to purchase South Korean arms in Warsaw, Poland, in 2022. (Joint press corps of the Defense Ministry) |

South Korea's top five commercial banks will provide the first tranche of a syndicated loan worth 3.5 trillion won ($2.65 billion) to the Polish government to finance a follow-up weapons purchase deal with Korean arms companies, industry sources said Friday.

This decision came after South Korea's Defense Ministry asked the top five commercial banks -- KB Kookmin, Shinhan, Hana, Woori and NongHyup -- to provide the lending during a meeting held on Nov. 6, as state-run banks hit their loan limit for the contract.

Although commercial banks declined to provide details about the loan on Sunday, industry sources say the lenders are also discussing providing additional loans after the first tranche, as the private sector is required to contribute around 10.8 trillion won in total.

The second round of the deal with Poland will be “slightly larger” than 30 trillion won, Export-Import Bank of Korea Chairman Yoon Hee-sung said at a parliamentary audit on Oct. 24

Yoon said that the specific amount requested by the Polish government has not yet been decided.

"We will have to talk more, as the assistance begins in 2026," he added.

In arms sale contracts, it is customary for the bidding country to help the country in charge of the order secure finances, as the deals are often sizable and take some time to process.

According to sources, the Polish government is currently requesting financial support of around 80 percent of the deal worth approximately 30 trillion won. This means that support of about 24 trillion won is estimated to be needed.

However, the problem is that the state-run lender had nearly reached its lending limit. Under the law, the state bank can lend up to 40 percent of its equity capital to a borrower. There is also a limit to the equity capital of the state bank.

Since Eximbank's equity capital stands at its limit of 15 trillion won, it can only provide 7.35 trillion won as a loan. Having financed 6 trillion won for the first deal with Poland last year, the state-run bank is left with just around 1.35 trillion won in assistance capability for the second deal.

In August 2022, Korean defense companies and Poland signed a comprehensive arms agreement under which local companies, including Hyundai Rotem, a defense provider under automaker Hyundai Motor Group, and Hanwha Aerospace, an affiliate of energy-to-defense conglomerate Hanwha Group, would supply tanks, howitzers and fighter jets to the Polish government.

The arms deal was worth $13.7 billion, making it South Korea's largest to date.

The remaining assistance required other than the banks’ syndicated loan will likely come from raising Eximbank's equity capital limit, as the National Assembly is considering doubling the equity capital limit to around 35 trillion won.

The Poland deals are crucial for South Korea to become a major player in the global arms export market, which has traditionally been dominated by the US and Russia.

According to a recent report from the Stockholm International Peace Research Institute, South Korea's arms exports increased by 74 percent in the past five years, reaching $17 billion in 2022.

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)