|

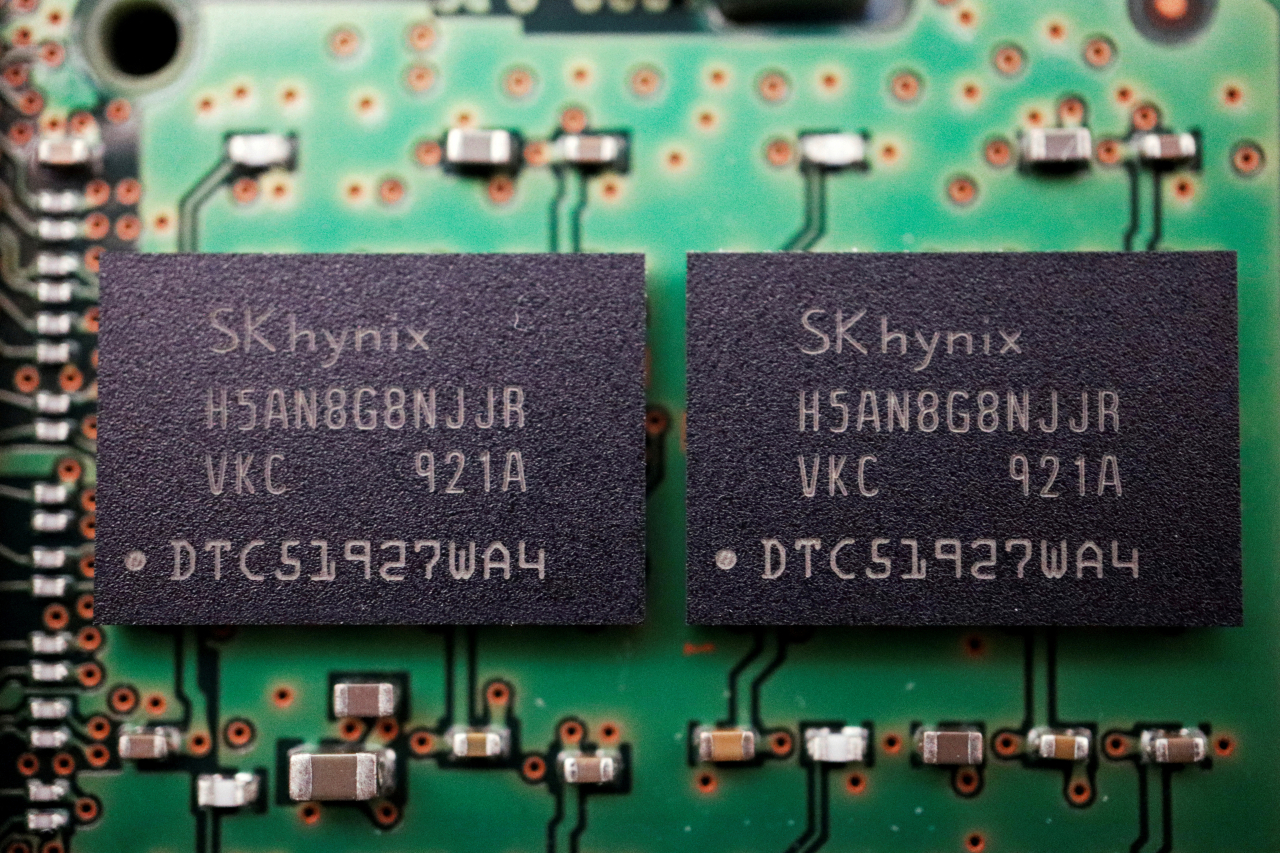

SK hynix's memory chips are seen on a circuit board of a computer. (Reuters-Yonhap) |

The victory of the US-friendly Democratic Progressive Party candidate Lai Ching-te in Taiwan's presidential election has raised concerns about its potential impact on the Korean semiconductor industry and the global supply chain.

South Korea's two leading semiconductor makers -- Samsung Electronics and SK hynix -- are reviewing the impact of the election results on the global foundry market, but the outlook appears mixed, experts said Monday.

Experts pointed to the geopolitical risks fueled by the escalating US-China rivalry over Taiwan and the strengthening of economic sanctions, as well as a possible change in the future business strategy of Taiwan Semiconductor Manufacturing Co., or TSMC, as key variables.

Some market experts and industry sources expect Korea to benefit from strained relationship between the US and China following the election results. They believe China may increase all-out pressure on Taiwanese semiconductor makers. In that case, global firms could prefer Korean chipmakers to avoid supply risks.

Taiwan is home to TSMC, the world's largest foundry that counts major technology firms such as Apple, Qualcomm, and Nvidia as its clients. It has been working closely with the US in the global supply chain of advanced chips and is both a key competitor and the sixth-largest trading partner to Korea.

“If China mobilizes economic, diplomatic and military means to put pressure on Taiwan, it will lead to risks for global companies that need to supply cutting-edge chips. Global companies will end up turning to Korea, Taiwan's most powerful alternative in the global semiconductor supply chain,” an industry source told The Korea Herald on condition of anonymity.

Hyundai Motor Securities analyst Jung Jin-soo also predicted that China, which had concentrated on Taiwan for its chip imports, may start to turn back to Korea as a supplier.

On the other hand, some experts expressed concerns that if the level of US-China rivalry intensifies beyond the current level, it will "spill over" to Korea.

The US currently uses Taiwan to keep China in check in the supply chain of advanced industries such as semiconductors. If US-China relations escalate further, there is a possibility that the US will put even more pressure on China.

Lee Jong-hwan, a system semiconductor engineering professor at Sangmyung University, said it was necessary to consider a number of worst-case scenarios.

"(The election result) will worsen relations between Taiwan and China, resulting in restrictions on China's imports of Korean semiconductors and, in extreme cases, the withdrawal of Korean semiconductor firms from China," the professor said.

Another possible negative factor could be TSMC's global market share increases after the US-led reorganization of the global chip supply chain.

"There could be a chain of negative effects on Korea, which has formed an advanced technology alliance with the US," another industry source said on condition of anonymity.

Taiwan has strong competitiveness in the chip sector, which the US has announced a policy of actively fostering from a national security perspective. According to market research firm Trend Force, TSMC's market share stood at 57.9 percent as of the third quarter, overwhelmingly widening the gap with Samsung Electronics which marked 12.4 percent.

Park Jae-geun, head of the Korean Society of Semiconductor and Display Technology and a professor of electronic engineering at Hanyang University said, the Taiwanese government's intention to invest in its chip makers may challenge Samsung Electronics to catch up with TSMC in the foundry market.

On the other hand, some experts said the Taiwan election would less likely have an impact on the Korean chip industry. There will be no meaningful change to the US-led semiconductor alliance known as "Chip 4," they said, while some industry sources worry about Korea being isolated from the grouping.

"We do not expect the outcome of the Taiwan election to change the situation significantly, as the fundamental variable is what kind of public export controls the US imposes," said Yeon Won-ho, head of the economic security team at the Korea Institute for International Economic Policy.

"Since the US has the original technology and is controlling it, changes will not occur easily to the 'Chip 4' formation, which will take more power over others," said Kim Yang-paeng, a senior researcher at the Korea Institute for Industrial Economics and Trade.

"Besides, Korea has never properly intervened in the cooperative relationship between Taiwan and the US, there's no way for the situation to get any worse for the local chip industry," the researcher added.

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)