|

Lewis Black, CEO of Almonty Industries, poses for a photo before an interview with The Korea Herald at the office of Almonty Korea Tungsten in Seoul on Tuesday. (Im Se-jun/The Korea Herald) |

Almonty Industries, a multinational mining company headquartered in Toronto, expects to reopen the Sangdong Mine in Yeongwol, Gangwon Province, and begin operations before the end of the year to offer an alternative source for tungsten, a critical material, according to the firm’s CEO Lewis Black.

"I think now we’ve finally got a clear path to reopen the world’s largest tungsten mine,” Black said in an interview with The Korea Herald at the office of Almonty Korea Tungsten in Seoul on Tuesday.

“And the beneficiary of this material will be both the United States and South Korea. We have no intention of supplying outside of those two areas.”

Tungsten, which features resistance to high temperatures, hardness and density, is a key material used for manufacturing automotive parts including batteries for electric vehicles, aerospace apparatuses and munitions. As China and Russia account for about 90 percent of the total global tungsten supply, geopolitical risks have consequently surfaced.

According to Black, the underground mine development will finish in September. The firm intends to begin surface work shortly.

The CEO explained that the production of the tungsten mine will be divided into two phases.

“The first phase 1, which is approximately 45 percent of the design output of the mine, goes to the United States,” he said.

“The second 55 percent, our marketing strategy is to make it only available for Korean companies. This is because Korea depends (on Chinese imports) for 94.7 percent of all tungsten.”

Black added that the mine developer intends to build a tungsten oxide plant in Yeongwol and provide roughly 4,000 tons of tungsten per year, which will be roughly over half of what Korea procures from China. According to the CEO, global tungsten production is approximately 98,000 tons per year, and about half of that is consumed in China.

“Sangdong will be a significant producer and it will be by far the largest producer outside of China,” he said.

“(Sangdong) is going to run for 100-plus years. Our mine in Portugal is still operating. It’s going for 136 years and it probably has another 50 or 60 years left. Sangdong is of equal size. It’s a vast deposit. It’s an extraordinary mine.”

|

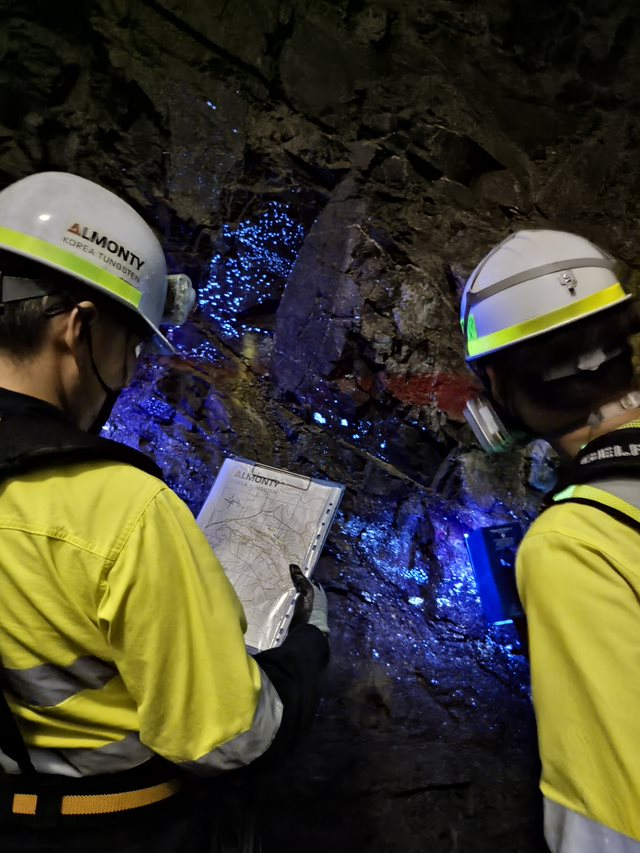

Almonty Korea Tungsten workers examine natural deposits at the Sangdong Mine in Yeongwol, Gangwon Province. (Almonty Korea Tungsten) |

According to Black, the average quality of the Sangdong Mine is 0.45 to 0.5 percent, the highest level and more than 2.5 times the global average, whereas the average quality of a Chinese tungsten mine is 0.18 percent.

Asked whether any talks with Korean companies are ongoing over a possible supply agreement for tungsten, Black noted that discussions have begun.

“We had some conversations even this morning. We can’t disclose who it is but it’s a very significant industrial player here in Korea,” he said.

“This is another reason why I’m here to start these conversations of fulfilling the government’s ambition to have greater transparency with a strategic metal.”

Almonty acquired the Sangdong Mine in 2015. The company signed an agreement with KfW-IPEX Bank in Germany for a loan of $75.1 million in 2020. The mine developer announced in November last year that it received a sixth drawdown of $13.7 million from the German bank to bring the total amount of drawdowns to $53.9 million.

According to the mine developer, it has so far invested over 120 billion won ($90 million) for additional drilling, acquisition of the site, ordering equipment, purchasing parts and paying wages for local workers.

Black pointed out that every direct job in the mining sector creates six jobs, underscoring the project’s strong economic impact on Yeongwol, which once had 40,000 residents during the mine’s heyday in the 1950s, '60s and '70s. Back then, the mine played a powerhouse role in the Korean economy as one of the biggest tungsten producers and exporters across the world.

Sangdong Mine, however, could not stand its ground against the low price of Chinese tungsten later and eventually closed in 1994, devastating the livelihoods of nearby residents. The town was in a bad condition at the time of Almonty’s mine acquisition.

“When we first bought the site, the village was very run down with a lot of empty buildings … the road was neglected … the village just looked abandoned,” said Black.

“Fast forward to today. The road is new. There are buildings that are either gone or have been repainted. When people start to believe in a future again, they take pride in their environments and one of the wonderful things I’ve seen is how the village has come back alive. That tells me that we’re doing the right thing here. We’re heading in the right direction.”

|

Almonty Korea Tungsten employees carry out excavation work with a jumbo drill at the Sangdong Mine in Yeongwol, Gangwon Province. (Almonty Korea Tungsten) |