|

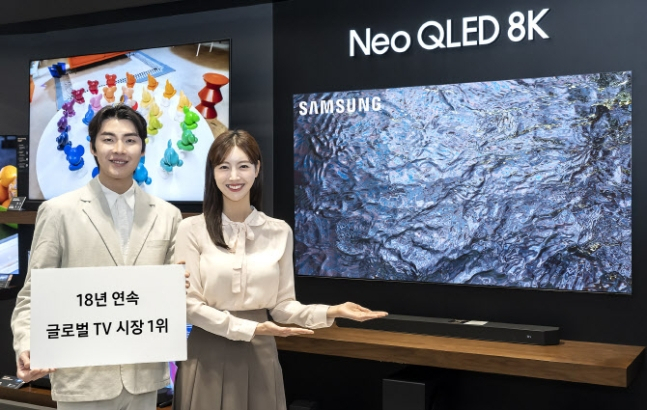

Samsung Electronics took top position in the global TV market for the 18th consecutive year in 2023. (Samsung Electronics) |

Korean TV makers Samsung Electronics and LG Electronics cemented their leadership in the global premium TV market in 2023, but they have been warned to gear up for Chinese rivals flooding the market with cheaper products.

In the premium sector for TVs priced at higher than $2,500, Korean manufacturers saw notable growth, together taking 79.6 percent of the market share by revenue, according to market tracker Omdia on Thursday.

Holding an edge in manufacturing technology for the higher-end TVs, the Korean companies beat their crossborder rivals by big margins. Samsung achieved a market share of 60.5 percent and LG marked 19.1 percent, while Japanese supplier Sony came third on the list with 15.9 percent. Chinese manufacturers Hisense, Panasonic and TCL each took less than 1 percent of the market share.

For large-screen TVs with over 75-inch displays, Samsung took 33.9 percent of the share to lead the market as well.

Korean TV makers also boasted supremacy in the advanced organic light-emitting display TV sector, with LG taking the top position at 48 percent market share by revenue and Samsung following with 22.7 percent.

Samsung's fast growth in the OLED market was notable, as it previously took just 6.1 percent of the OLED market as it first launched its OLED TV in 2022.

Despite the strong lead, market observers here have raised concerns as Chinese rivals are aggressively expanding their positions in the overall TV market.

In 2023, Samsung topped the global TV market for an 18th consecutive year, taking 30.1 percent of the total revenue, according to Omdia, a market tracker on Thursday.

But LG's performance came short of expectations, giving way to Chinese rivals TCL and Hisense to land at No. 4 in the global TV market for the first time. LG's total shipments were 11.2 percent of the global market, lower than TCL's 12.5 percent and Hisense's 11.4 percent.

"LG Electronics' TV business, which posted a profitability rate of 7 to 9 percent from 2017 to 2019, centered on OLED TVs, and the rate is unlikely to improve in the short term," said Noh Geun-chang, a researcher at Hyundai Motor Securities.

Noh forecast that the operating margin for LG's TV business this year would reach only 2.3 percent, down from 2.5 percent last year.

Following ample demand to replace TVs during the COVID-19 pandemic, demand is largely expected to remain low in the coming years. Chinese display makers, which dominate in liquid crystal displays, are also likely to keep their product prices up now, so LG is likely to face difficulties in gaining back its market share as measured by revenue, Noh predicted.

"LG Electronics is leading the OLED market, but it appears unlikely to record the same growth rate as in the past," said Noh. "LG Electronics has entered a low-growth phase for TVs after restructuring its smartphone business."

To maintain the gap with their aspirational rivals, both LG and Samsung said their strategy is to keep up their leadership in the premium TV segment. They both plan to introduce artificial intelligence services to adopt up-to-date processors.

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)