|

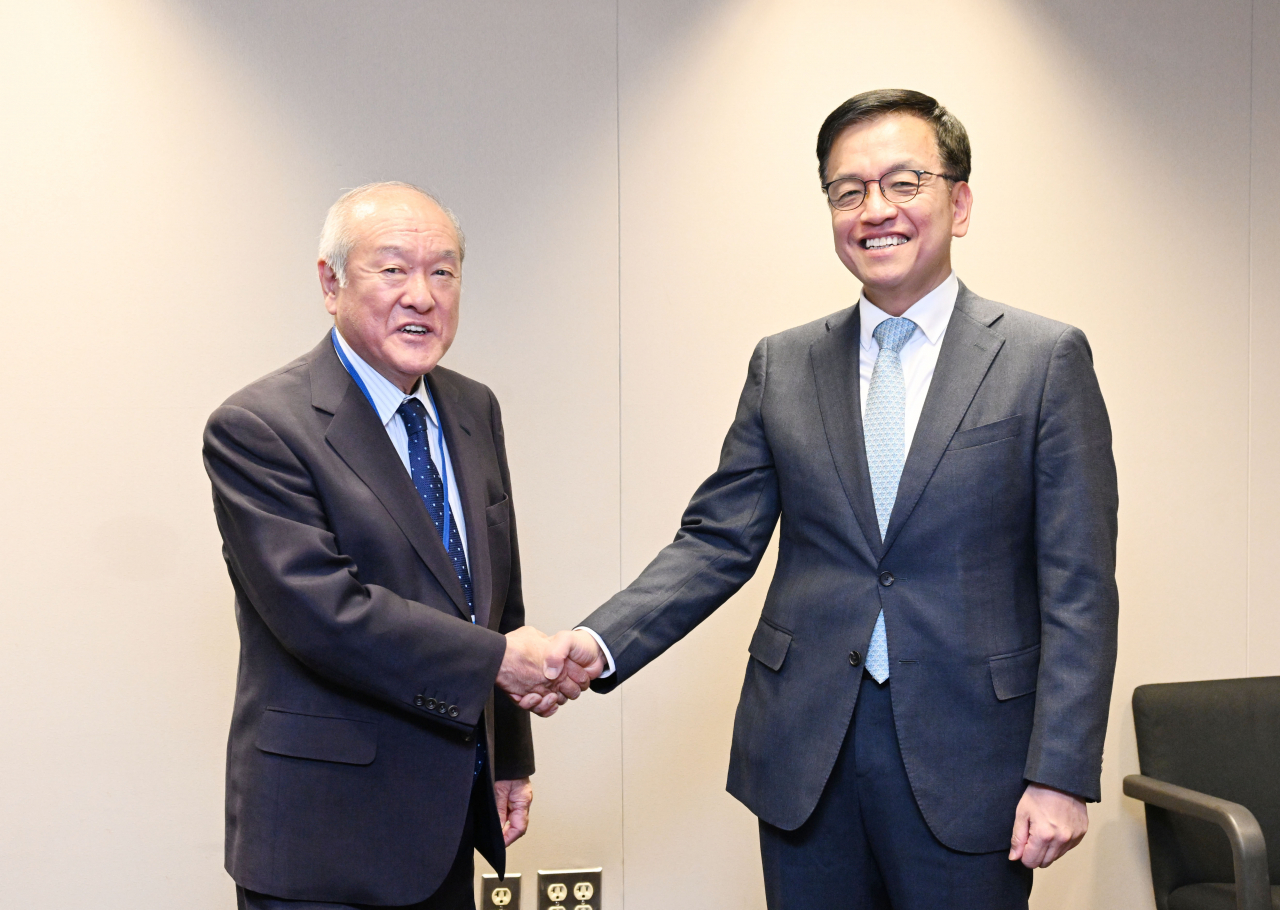

South Korea's Finance Minister Choi Sang-mok (right) and Japanese Finance Minister Shunichi Suzuki shake hands ahead of their meeting in Washington on Tuesday, which was held on the sidelines of the meeting of G20 Finance ministers and central bank heads and the annual Spring Meetings between the International Monetary Fund and the World Bank. (Yonhap) |

South Korea and Japan’s finance ministers voiced concerns over the recent depreciation of their currencies against the US dollar, showing their intention to step into the market to support the won and yen, according to Korea's Finance Ministry on Wednesday.

Finance Minister Choi Sang-mok met with his Japanese counterpart Shunichi Suzuki on Tuesday for the first time since he took office on the sidelines of the G20 Finance Ministers and Central Bank Governors Meeting in Washington.

“Regarding foreign exchange market developments, the two ministers shared serious concerns about the recent significant depreciation of the Japanese yen and the Korean won, and expressed their intention to take appropriate actions against excessive movements,” Korea’s Ministry of Economy and Finance said in a statement.

Their dialogue took place after the Korean won slid to the 1,400 won level against the greenback for the first time in 17 months, while the yen set a fresh 34-year-low amid prospects that the US Federal Reserve will maintain its high rates longer than previously anticipated. Federal Reserve Chair Jerome Powell's hawkish remark Wednesday signaled delayed interest rate cuts after data suggesting inflation is not cooling fast enough.

Geopolitical tension from the Middle East induced further market volatility. Iran launched hundreds of missiles and drones at Israel on Saturday in response to an apparent Israeli strike on Iran’s embassy compound in Syria on April 1, which left 12 people dead.

During Tuesday's meeting, the finance chiefs of the two countries agreed to further strengthen bilateral cooperation between Korea and Japan for economic development.

Korea will host the next regular annual meetings between the two countries’ finance ministers shortly. The last meeting was held in Tokyo in June last year, as they resumed talks after years of suspension since 2016 due to disputes over wartime history.

“They also agreed on the importance of communication and cooperation between the two countries, as partners pursuing common interests in international and regional issues,” the ministry said.

The two held their first trilateral meeting with US Treasury Secretary Janet Yellen on Wednesday to discuss sanctions on Russia and Iran to secure supply chains and ways to build climate and financial resilience in the Pacific Islands. The US and its allies planned new sanctions against Iran over its first direct military action targeting Israel from its own soil, according to Reuters.

This year, the US dollar gained 4.9 percent while the won plummeted about 7 percent, as the won has become synchronized with the weakening of the Japanese yen and Chinese yuan. Surging international oil prices that have exceeded $90 per barrel also drag down the won as the country is heavily dependent on energy imports and vulnerable to commodity prices.

Separately, Bank of Korea Governor Rhee Chang-yong, who is also visiting Washington for the G20 event, assessed that the recent foreign exchange market volatility is “excessive,” expressing the central bank’s readiness to take actions for market stabilization in an interview with CNBC.

"I think the recent movement is a little bit excessive, so we are ready to deploy stabilization measures if the volatility continues. And we have enough tools and resources to do so," he said.

With the remarks from the Korean financial minister and BOK governor on possible market intervention against the won’s sharp decline, the won strengthened on Wednesday to break its seven-day losing streak. The won gained 7.70 won to 1386.80.

Despite the calm in exchange rate markets, Korean stocks traded lower as most big-cap shares slid on foreign sell-off. The benchmark Kospi fell 0.98 percent to close at 2584.18, the lowest mark in more than two months since Feb. 6.

Weighing down on the index were both foreign and institutional investors who dumped 179.6 billion won and 201.2 billion won worth of shares.

The secondary Kosdaq ended at 833.03 points, up 0.03 percent from the previous day.

![[Music in drama] Rekindle a love that slipped through your fingers](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050484_0.jpg)