Mirae Asset Securities, South Korea's largest stock brokerage company, has been achieving feats in global markets through localization schemes coupled with strategic takeovers of local players.

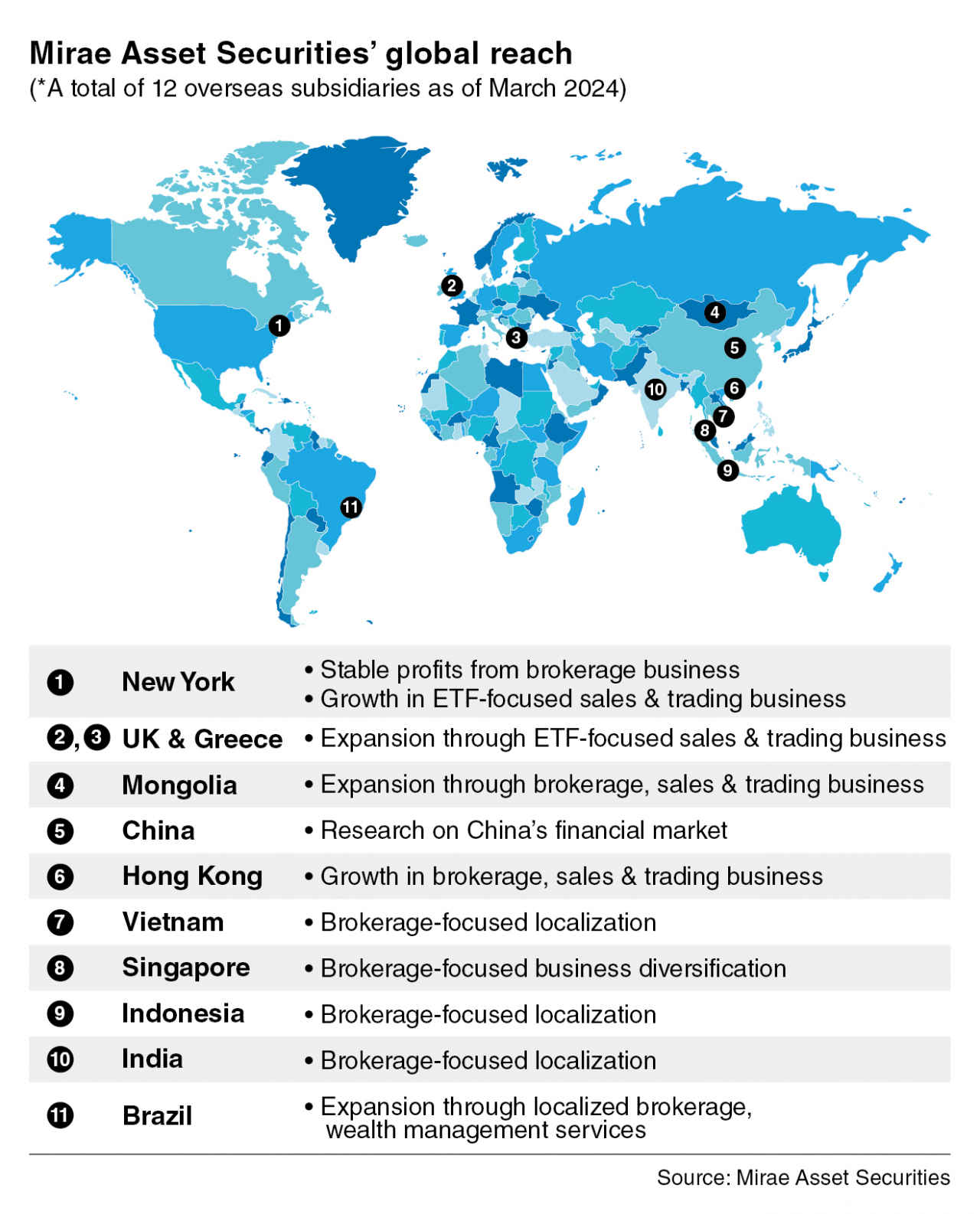

As of March this year, it operates a total of 12 overseas subsidiaries, spanning the US, Brazil, the UK, Greece, Mongolia, India, Indonesia, Vietnam, Singapore, Hong Kong and China.

In recognition of Mirae Asset Financial Group’s robust global growth, Chairman Park Hyeon-joo is to receive the International Executive of the Year Award at next week’s annual conference of the Academy of International Business in Seoul. Park has been serving as the group’s global strategy officer since 2018.

Bigger footing

According to the company, Mirae Asset Securities customers earned more than 1 trillion won ($720 million) in profits through overseas stock investments last year alone. Their cumulative income made since 2020 has surpassed 4.5 trillion won.

The company first ventured into markets beyond Korea by establishing a subsidiary in Hong Kong with an equity capital of $5 million in 2004. Over the past two decades, the subsidiary’s capital has grown over $3.4 billion, a nearly 600-fold increase.

More recently, one of its key growth markets is India, a fast-growing economy where the company has sought to secure a footing since its entry in 2018.

The company poured considerable resources into digital transformation, among other things there, which led to the launch of an online retail trading platform in 2022. In February, its Indian business unit secured 1 million accounts.

In December last year, it also announced the acquisition of Sharekhan Limited, India’s ninth-largest securities company, in a $370 million deal. Founded in 2000, Sharekhan has a total of 3,500 employees, about 3 million accounts and 130 branches in 400 regions across India.

While tapping into the Indian capital market, the firm has been making bold investments in nonfinancial companies as well.

The Mirae Asset-Naver Asia Growth Fund, a joint fund pooled by Mirae Asset Securities and Korean tech giant Naver, has recently recovered 80.7 billion won through the sale of a stake in Zomato, a leading player in India's food delivery industry. The fund’s remaining stake in the company is valued at 38.6 billion won.

This marks a 2.7-fold rise in estimated value from an initial investment of 44.6 billion won, which grew to 119.3 billion won in four years.

Furthermore, the brokerage firm has been making accomplishments in Europe's capital market.

Mirae Asset Securities' London subsidiary acquired GHCO, a European finance firm in May 2023. Founded in 2005, GHCO is a market maker that provides liquidity for more than 2,500 ETF products and 19 ETF issuers, including big names such as BlackRock and Vanguard. It has an in-house market-making system, which can cover up to 14,000 ETF products across the world.

The firm viewed that the takeover could pave the way to venturing into the European ETF market, the second-largest following that of the US, in synergy with ETF manager Global X under Mirae Asset Financial Group.

“The global business environment has been challenging with inflation and the interest rate hikes, but Mirae Asset is securing the foundation of long-term growth through overseas business expansion and investments into innovative companies,” an official from Mirae Asset Securities said.

“Mirae Asset Securities will secure the lead in its business, and continue to strive to become a global top-tier investment bank,” the official said.