|

Kumyang's 4695 cylindrical battery cells are on display at InterBattery 2024 at Coex in Seoul, March 6. (Kan Hyeong-woo/The Korea Herald) |

South Korean battery-maker Kumyang unveiled the world’s first 4695 cylindrical battery cell, which the company claimed to have greater capacity than Tesla's 4680 battery, at InterBattery 2024 at Coex in Seoul in March this year.

Oxford Metrica, a UK-based global advisory firm, recently analyzed that 600 Kumyang 4695 cells can generate 75 kilowatt-hours of energy to offer about 600 kilometers in driving distance, whereas the same number of Tesla 4680 cells would create about 52 kWh to provide a driving distance of 416 km, highlighting that the Busan-based firm’s battery has a 44 percent greater range than the US electric vehicle giant.

Kumyang announced in July this year that the company is targeting June 2025 to begin mass production of the 4695 cells, saying that the company is in talks with a number of potential clients in and out of the country about potential contracts for supplying its 2170 and 4695 cells. Kumyang had previously developed the 2170 cells in 2022 and is producing 7 million 2170 cells per year on a pilot line.

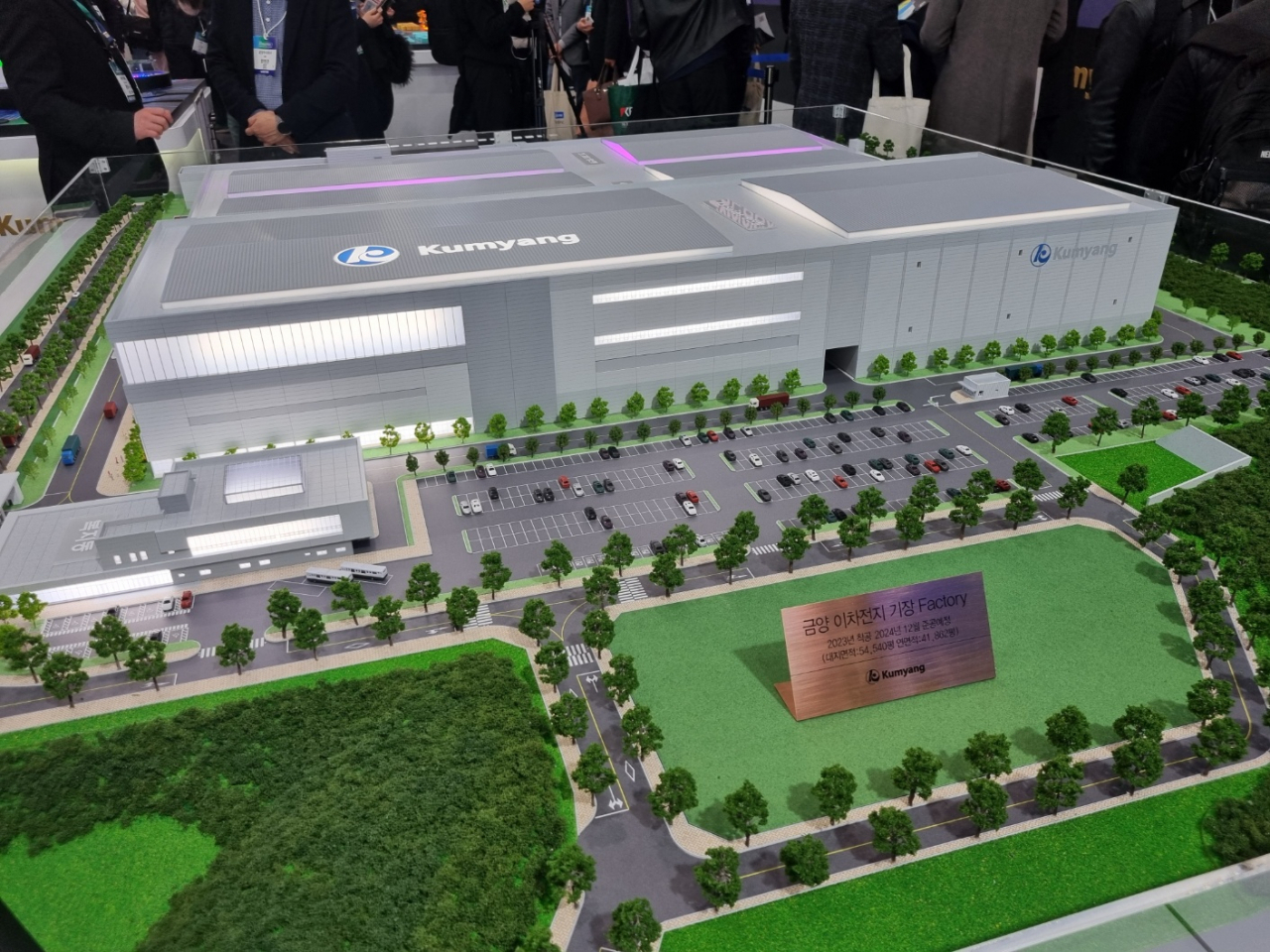

The company set the target of producing 3.7 gigawatt-hours of the 2170 cells and 12.6 GWh of the 4695 cells per year at the Gijang manufacturing site in northern Busan, which is currently under construction, enough to power about 216,000 EVs.

About seven months after the debut of Kumyang's 4695 cylindrical battery cell, the battery-maker’s ambitious and rosy outlook took a beating after a series of mishaps in October dampened the company’s credibility.

The Korea Exchange designated Kumyang as an unfaithful disclosure corporation on Oct. 28 after the battery-maker had issued a correction notice to lower projections for its sales from a Mongolian mine.

In May 2023, Kumyang said in a regulatory filing that it expected to garner 402.4 billion won ($292 million) in revenue and 161 billion won in operating profit from the Mongolian mining business. However, the company revised the respective targets to 6.6 billion won and 1.3 billion won on Sept. 27, drawing backlash from the financial authorities. As a result, the Korea Exchange imposed a fine of 200 million won and 10 demerit points on Kumyang.

On top of the trust issue, SMLAB, formerly known as Singular Materials Laboratory and a battery materials firm that has Kumyang as its biggest shareholder with a 22.31 percent stake, failed to pass the screening process for an initial public offering.

According to local media reports, the Korea Exchange on Oct. 28 deemed that SMLAB’s financing plan for building a cathode active material plant was unstable. The financial authorities’ decision came about six months after the company filed for a review to be listed on the country’s secondary tech-heavy bourse Kosdaq in April this year.

A day after the designation of the unfaithful disclosure corporation, Kumyang posted an official apology on its website.

“We failed to meet the market's expectations and live up to the shareholders’ support as overseas supplier orders and financing were delayed due to negative factors such as trial and error in the overseas mining business and shrinking global battery market,” the company said.

Kumyang vowed to expand its mining capabilities to speed up the related business and create an innovative corporate culture that can achieve sustainable growth.

Following the apology, Kumyang CEO Ryu Gwang-ji, the biggest shareholder of the company with a 35.62 percent stake, decided to donate 10 million shares through a bonus issue to the company. Based on Kumyang’s closing price on Oct. 31, the value of the newly issued shares would come out to 415 billion won.

The company also announced it will carry out a third-party allotment of new shares worth 300 billion won. The company will issue some 5.91 million new shares at the price of 50,700 won. The recipients are Ryu and his two companies, KJ International and KY ECO.

The third-party allotment is expected to lower Kumyang’s debt ratio, which was 430 percent by the first half of this year, as it is a debt-equity swap of the 300 billion won that Ryu and his two companies had lent to Kumyang.

Kumyang noted that such financing plans were drawn out on the strong commitment and determination of the largest shareholder to maximize shareholder values, especially through the smooth completion of a second factory in Busan, which is currently 73 percent complete, for the production of secondary batteries.

|

A rendering of Kumyang's battery plant in Busan is on display at InterBattery 2024 at Coex in southern Seoul, March 6. (Kan Hyeong-woo/The Korea Herald) |

![[Herald Interview] How Gopizza got big in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/20/20241120050057_0.jpg)