|

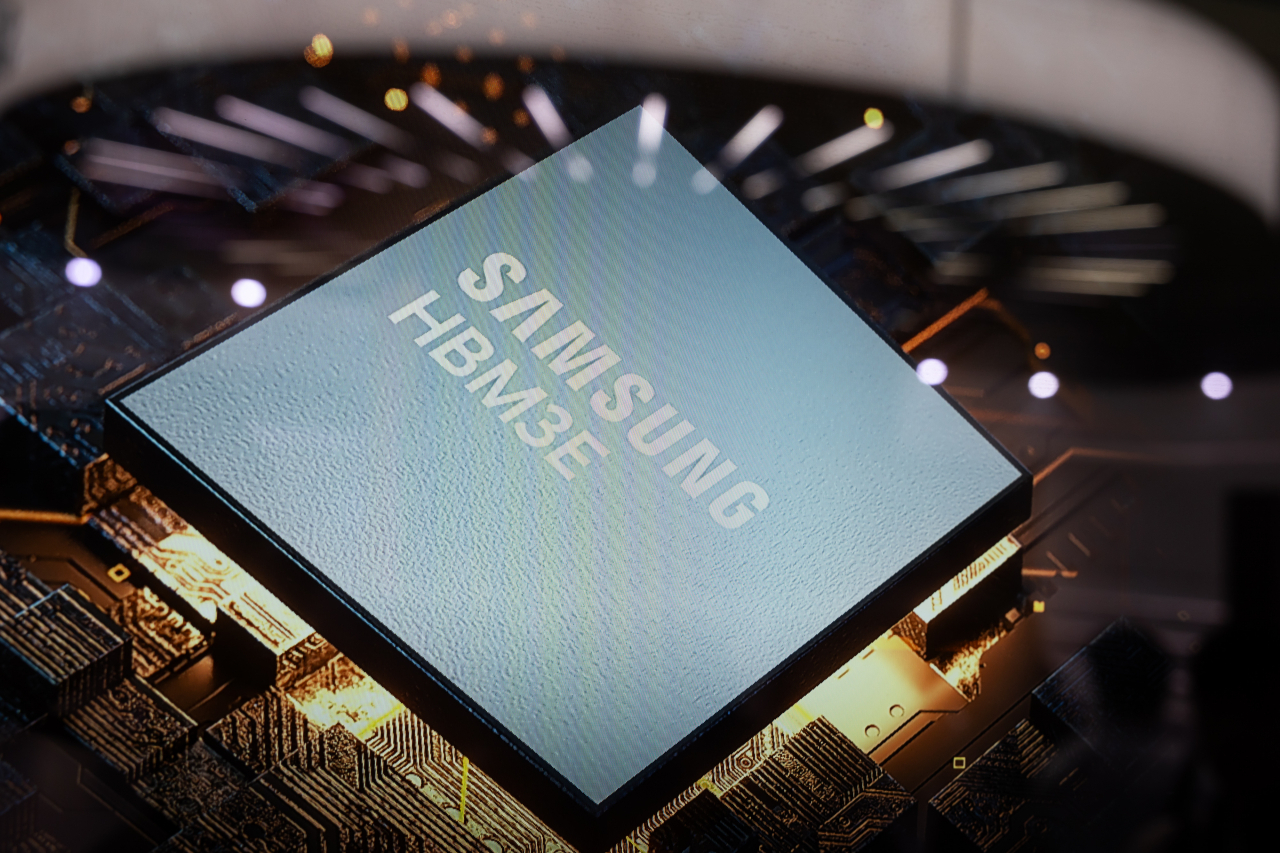

A Samsung 12-layer HBM3E memory chip on a monitor at the Semiconductor Exhibition in Seoul on Oct. 23. (Bloomberg) |

Samsung Electronics, the tech giant known for its independence as a manufacturer, made a surprise announcement last month hinting it may outsource a key component of its cutting-edge artificial intelligence chips to its Taiwanese rival TSMC.

Experts say this comes as the world's largest memory chip maker faces mounting pressure from its global competitors in the increasingly crucial AI chip sector, a headwind that has directly contributed to Samsung's earnings slowdown.

“We are currently developing (the 6th generation) HBM4 for mass production in the second half of next year,” Kim Jae-june, executive vice president in charge of memory marketing strategy, said during an Oct. 31 call in which the company reported disappointing third-quarter earnings.

HBM4 is the sixth-generation High Bandwidth Memory chip, a key component in enhancing the AI capabilities of the graphics processing units that are currently in high demand.

"For custom HBM chips, it is crucial to meet the requirements of the customers. So we plan to respond flexibly in selecting foundry partners for base die manufacturing, prioritizing customer needs," Kim said.

In the July-September period, Samsung’s semiconductor business posted a much lower-than-expected operating profit of 3.86 trillion won, roughly half of what crosstown rival SK hynix earned in the same period.

Samsung's lag in the high-value HBMs, or stacks of cutting-edge DRAM chips, has been cited as a leading cause for its fall behind SK hynix -- traditionally the runner-up, but now securing a dominant position in the HBM market.

Outsourcing to rival

As Kim said, HBM chips -- a package of vertically stacked DRAMs -- are highly customizable and made to order, unlike typical DRAM chips for which the manufacturer chooses the time and volume of production.

With the next-generation HBM4 models expected to incorporate logic chips as the base die of the DRAM stack, the recent remark by the Samsung executive signals that the company might consider outsourcing base die manufacturing to competitors outside its own foundry business.

While Samsung did not specify the potential partner for the orders, TSMC is a likely candidate considering how it is the unrivaled leader in the foundry business, producing over 90 percent of the world's most sophisticated chips.

As an integrated device manufacturer that covers all areas of semiconductor production -- memory, logic chip design and contract manufacturing -- Samsung would ordinarily want to handle the entire HBM production process itself, "killing two birds with one stone," as Lee Jong-hwan, a system semiconductor engineering professor at Sangmyung University, said.

“But the company now understands it is not the time to be weighing options, so it is making a strategic shift to secure at least one.”

For Samsung, partnering with TSMC would mark a shift in its long-standing strategy of "vertical integration," in which the company controls every step of production -- from components to assembly -- to maximize profit from each product.

It would also mean the company is stepping back from its earlier goal of overtaking its Taiwanese rival by 2030, which leads the global foundry market with a 62 percent share as of the second quarter this year. Samsung remains a distant No. 2 with a 13 percent share.

The Korean foundry had appeared to be on course to carve out its share in the foundry market, developing the cutting-edge 3-nanometer process for advanced chipmaking earlier than its competitors in 2022. But it has been struggling to attract customers, as it failed to achieve a yield rate sufficient for stable supply.

Samsung maintains that nothing has been decided regarding base die manufacturing for its HBM4. At the same time, the company is revamping its memory chip division, relocating its logic chip engineers to focus on developing the base die.

"We are still in talks with our major clients, and nothing has been decided on any collaborations," a Samsung official said.

SK hynix, which is the main supplier of the latest generation HBM3E to Nvidia, has already teamed up with TSMC to outsource the base die of its HBM4 chips for the US-based GPU maker, the market's largest client.

Earning trust from big tech

To leverage its strength as an integrated device manufacturer, Samsung must boost its technological edge and secure a high enough yield rate to earn the trust of global tech giants that have close ties with TSMC, experts say.

"Companies like Nvidia would prefer to have everything made in one place, and Samsung has the capability to provide that," Lee of Sangmyung University said.

"But these major tech firms have long-standing relationships with TSMC, and they believe Samsung lacks the level of expertise and consistency that TSMC has. So Samsung needs to show that it has comparable technology and break this established cycle of trust."

David Yoffie, a professor at Harvard Business School who served on Intel Corp.’s board, said Samsung would ultimately have to spin off its foundry business in order to attract big tech customers, an idea Samsung Chairman Lee Jae-yong publicly dismissed.

"It would be difficult for Samsung to win customers when it is competing head-on with the biggest foundry customers, such as Apple in its other business areas," Yoffie told The Korea Herald via email.

"Most foundry customers prefer to do business with TSMC because TSMC does not compete with them."

HBMs are expected to account for a greater portion of sales for Samsung and SK hynix in the coming years. For SK hynix, HBMs are expected to account for nearly 40 percent of its DRAM sales in the October-December period. Samsung is also ramping up efforts to start the first shipment of its 12-layer HBM3E chips to Nvidia in the fourth quarter.

![[Herald Interview] How Gopizza got big in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/20/20241120050057_0.jpg)