Attention is being paid to U.S. activist hedge fund Elliott Associates’ next step after it suffered a defeat in a shareholders vote on a merger deal between Samsung C&T and its sister firm last week.

At the crucial vote on Friday, nearly 70 percent of Samsung C&T shareholders supported a merger with Cheil Industries. The vote ended C&T’s six-week battle with the fund, which had sought to thwart the Samsung merger plan.

After Friday’s result, Elliott said it would reserve all options at its disposal, implying that its war was not yet over.

|

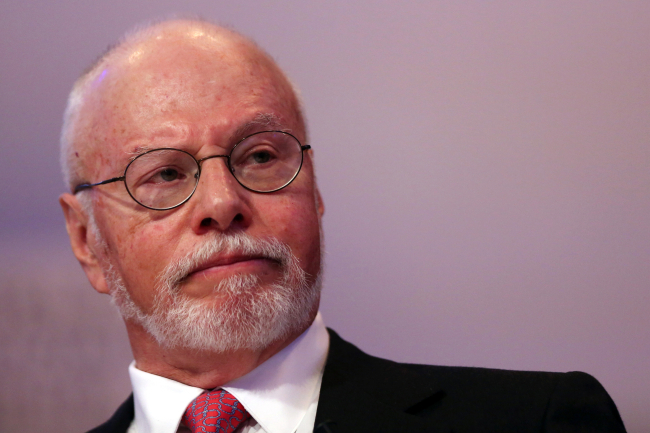

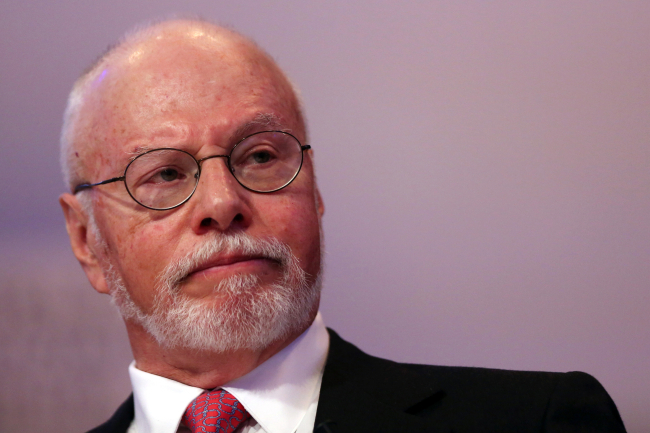

Paul Elliott Singer (Bloomberg) |

The first of Elliott’s options will likely be challenging the validity of the merger in court, according to market analysts.

Elliott, as a shareholder that would have a stake of more than 2 percent in the merged entity, is expected to file a suit to nullify the merger and review the legal basis of Samsung’s efforts to secure proxy votes from minority shareholders.

The fund has already laid the groundwork for legal actions by acquiring 1 percent stakes in Samsung SDI and Samsung Fire & Marine Insurance, both of which own C&T shares.

Under Korean law, Elliott can sue the directors of the two Samsung affiliates ― SDI and fire insurer ― for supporting the controversial merger deal and hurting the interests of their shareholders.

Seeking to replace the current C&T directors is another option.

“Activist hedge fund companies like Elliott have traditionally replaced directors to reflect their interests when their efforts to block a merger have failed,” said Yoon Seung-young, a researcher at Corporate Governance Service.

“Elliott could demand that Samsung change board directors, in partnership with other minority shareholders who opposed the deal,” he said.

Elliott’s campaign has awoken minority shareholders’ voices, making a lasting impact on shareholder rights in a country long known for weak corporate governance.

“Elliott’s challenge is pressuring Samsung Group, for the first time, to consider minority shareholders’ rights and objections,” Mark Newman, an analyst for Bernstein Research, wrote in a research report before the Friday vote.

By Suk Gee-hyun (

monicasuk@heraldcorp.com)

![[Breaking] South Korea's Han Kang wins 2024 Nobel literature prize](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/10/10/20241010050770_0.jpg)

![[KH explains] Will CATL’s Korean push reshape battery alliance with Hyundai, Kia?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/10/09/20241009050092_0.jpg)