|

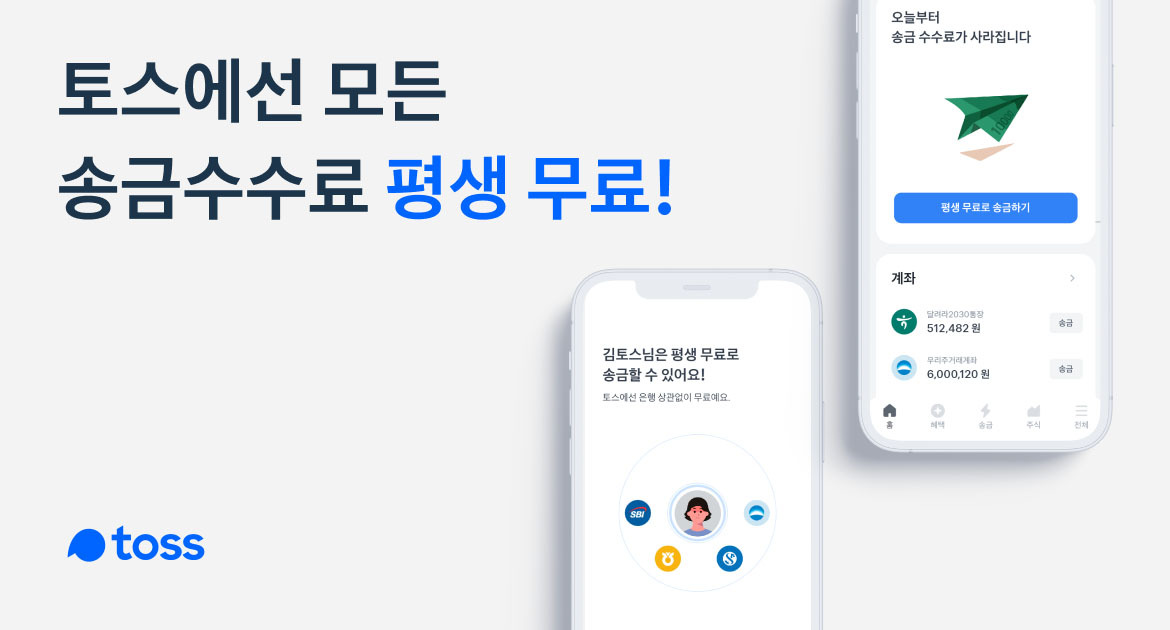

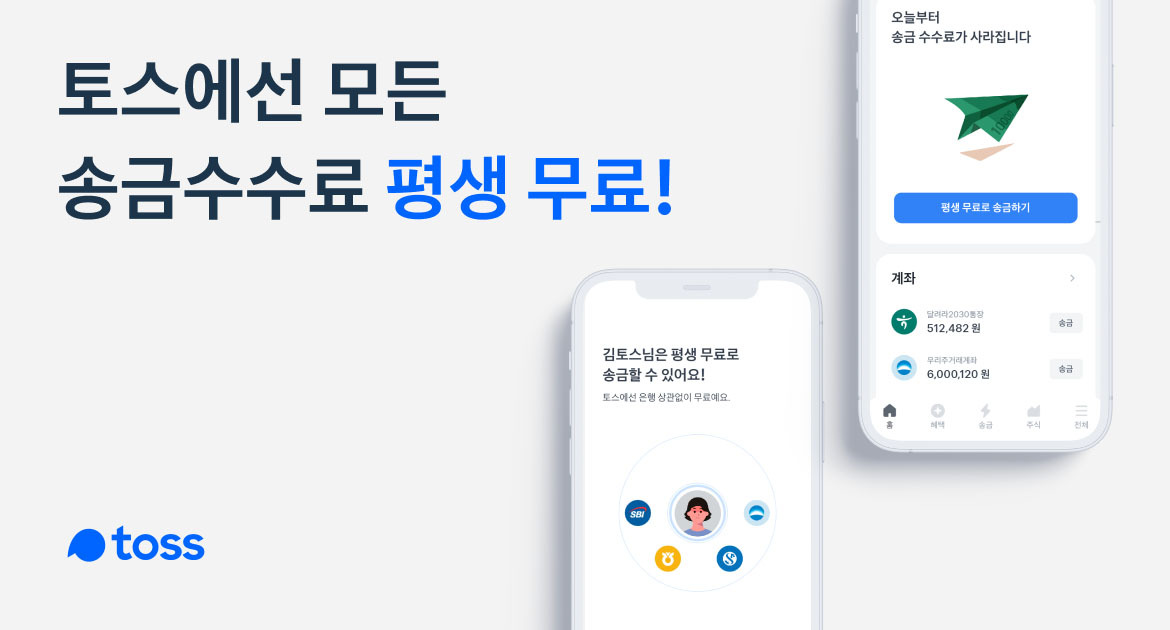

Toss decided to eliminate fees for remittance (Viva Repbulica) |

Viva Republica, South Korea’s leading financial technology company, announced Monday that it would eliminate transaction fees for Toss users, as it gears up for growing competition with internet-only banks and other fintech firms.

The app Toss, which handles up to 2 million won ($1,730) at any given time, previously charged 500 won for each money transfer after providing the first 10 transfers free. But starting from Monday, Toss users can transfer money at no cost.

The move comes as the fintech firm prepares to launch Toss Bank, the country’s third internet-only bank after KakaoBank and K bank, next month.

“We want to make a fundamental difference from other financial platforms by completely eliminating the psychological barriers for financial consumers in their most frequently used area -- remittance -- to maximize satisfaction,” said Lee Seung-gun, founder and CEO of Viva Republica, adding that the company‘s conclusion was made despite the apparent financial losses associated with the free transaction scheme.

The company’s executives declined to reveal the size of the financial burden the company will have to take on, but industry sources have speculated it would be more than 1 billion won. The cumulative amount of remittances through Toss has reached about 169 trillion won since the company’s foundation in 2015. A Toss executive said that about 30 percent of money transfer users made use of the service more than 10 times a month.

An industry executive said that the Toss move is inevitable, as other internet-only banks attract customers with free transaction fees and local banks offer no charge for their loyal customers.

“(Toss’ decision) was predicted as most customers can now enjoy free-of-charge transactions from various platforms, including fintech platforms and their main banks. Besides, internet-only banks already offer free transaction fees, so I expected Toss would make that move sooner or later,” a banking industry expert said on the condition of anonymity.

The size of the country’s simple remittance market is growing rapidly. Total simple remittances in 2020 stood at 130 trillion won, or an average of 356.5 billion won a day, 52 percent up from 2019’s 234.6 billion won, according to data from the Bank of Korea. Out of total remittances in 2020, 92 percent were done by fintech companies like Toss and Kakao Pay.

By Park Ga-young (

gypark@heraldcorp.com)