|

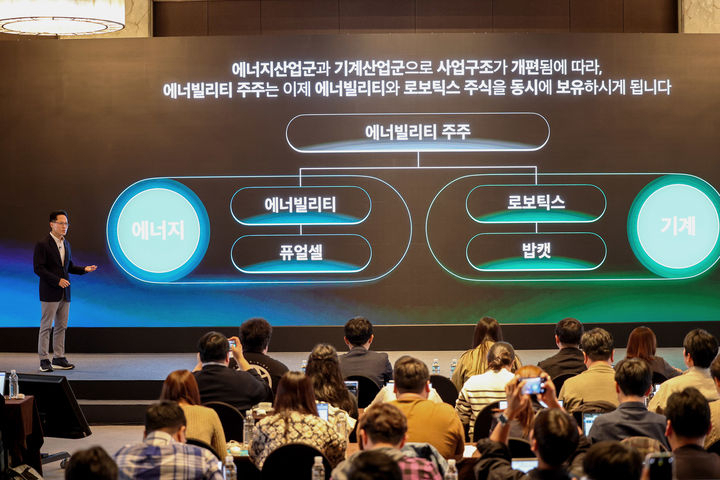

Doosan Enerbility CEO Park Sang-hyun explains the anticipated synergies behind Doosan Group’s restructuring plan, approved by regulators last Friday and awaiting shareholder approval, during an Oct. 21 press conference in Seoul. |

Doosan Group’s ambitious corporate restructuring plan, which will separate Doosan Bobcat from Doosan Enerbility and merge it into Doosan Robotics, is entering its final stages.

Following regulatory approval last Friday, the proposal now awaits a vote at a shareholders’ meeting on Dec. 12, marking the completion of a process that began four months ago.

The restructuring process has undergone six amendments to its securities filings since the plan was first announced on July 11, as Doosan worked to address regulatory and shareholder concerns. With final approval granted by financial authorities, the group must now secure approval from at least two-thirds of voting shareholders at the upcoming meeting, provided at least one-third of all shareholders participate.

If approved, shareholders will have until Jan. 2 next year to exercise their purchase rights, known as warrants. However, if the total number of shareholders exercising these rights exceeds Doosan’s proposed cap -- set at 600 billion won ($427.2 million) for Doosan Enerbility and 500 billion won for Doosan Robotics -- the company may need to revise its plans or even withdraw the restructuring, potentially delaying its Jan. 31 completion target next year.

Doosan has proposed warrant prices of 28,890 won for Doosan Enerbility and 84,772 won for Doosan Robotics. Friday’s announcement of regulatory approval boosted investor sentiment, with Doosan Enerbility’s stock rising 5.74 percent to 21,100 won and Doosan Robotics’ stock increasing 0.87 percent to 69,400 won.

The approved plan involves splitting Doosan Enerbility into two entities: one focused on its existing business operations and another holding a 46.06 percent stake in Doosan Bobcat. The newly formed holding company will then merge with Doosan Robotics. Under the finalized share exchange ratio, every 100 shares of Doosan Enerbility will convert into 88.5 shares of the same company and 4.33 shares of Doosan Robotics.

Doosan initially planned a full merger between Doosan Bobcat and Doosan Robotics via a 1:0.6 share exchange ratio, but the proposal faced significant backlash from minority shareholders. Many viewed the ratio as undervaluing Doosan Bobcat, a profitable business with annual operating income exceeding 1 trillion won, in comparison to Doosan Robotics, which generates only 20 billion won in annual operating income.

After pressure from the Financial Supervisory Service and minority shareholders, Doosan revised its approach. The new plan makes Doosan Bobcat a subsidiary of Doosan Robotics, while improving the share exchange ratio to 0.0433 Doosan Robotics shares per Doosan Enerbility share, up from the original 0.0315 ratio.

“This adjustment adds approximately 390,000 won in value for every 100 shares compared to the original proposal,” said Doosan Enerbility CEO Park Sang-hyun during a press conference last month.

Doosan is emphasizing the strategic benefits of the reorganization to win shareholder support. By integrating Doosan Bobcat’s extensive international distribution network with Doosan Robotics’ advanced technologies, including artificial intelligence and automation, the company aims to expand its footprint in global markets. Doosan Robotics will benefit from greater customer access and financial resources, while Doosan Bobcat will leverage robotics expertise to enhance automation in its core construction equipment business.

“We will fully explain to shareholders these synergies that the reorganization will deliver,” a Doosan official said.

![[Weekender] Korea's traditional sauce culture gains global recognition](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg)