|

Mario Draghi (right), president of the European Central Bank, and Mark Carney, governor of Bank of England, pose during the Group of Seven finance ministers and central bank governors meeting at Hartwell House in Aylesbury on May 10. (Bloomberg) |

FRANKFURT (AFP) ― Europe’s two most important central banks took unprecedented moves Thursday to reassure financial markets that interest rates on their side of the Atlantic are unlikely to rise any time soon.

Seeking to calm worries about the political crisis in Portugal and ease concerns that the prolonged period of easy money is coming to an end in the United States, the European Central Bank and the Bank of England separately pledged to keep their borrowing costs low for as long as needed.

The dovish comments triggered a rally in stock prices all around Europe, since it was the first time that either central bank had ever given such forward guidance, a move one analyst called a “mini-revolution”.

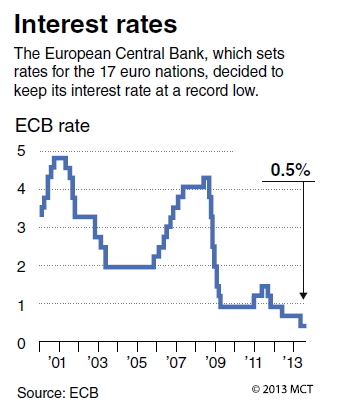

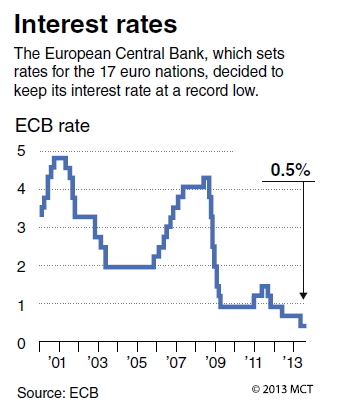

Speaking after the ECB held its key “refi” rate steady a 0.5 percent for the third month in a row, ECB chief Mario Draghi vowed that “monetary policy will remain accommodative for as long as necessary.”

The guardian of the euro “expects the key ECB interest rates to remain at present or lower levels for an extended period of time,” Draghi said.

“Our exit (from low interest rates) is very distant.”

In London, too, where the Bank of England also held its interest rate steady at 0.5 percent, the bank’s new governor, Canadian Mark Carney, hinted that there would be no rise in borrowing costs in the short term.

Draghi denied any suggestion that the announcements were in any way coordinated, insisting that the ECB’s decision was independent from any move by either the BOE or the U.S. Federal Reserve.

Financial markets have been spooked by the announcement last month that the U.S. Fed is preparing to phase out its bond-buying or so-called “quantitative easing” program, bringing the prolonged period of loose monetary policy to an end.

And the political crisis in Portugal had sparked fears of a new flare-up in the eurozone crisis.

In response, interest rates on sovereigns debt have risen across the euro area and financial conditions have generally tightened, albeit not dramatically.

Draghi insisted that Portugal had made “outstanding” progress in getting its finances and its economy in order and is currently “in safe hands”, after the resignation of finance minister Vitor Gaspar.

The results achieved have been “quite significant, remarkable, if not outstanding,” Draghi said.

The ECB was “assured by the new minister” Maria Luis Albuquerque, Draghi said.

![[Weekender] Korea's traditional sauce culture gains global recognition](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg)