DAEJEON -- An LG Chem researcher places two battery cells – one made with the company’s proprietary ceramic-coated safety reinforced separator, known as SRS, and the other made with polyolefin – on a hot plate of about 180 degrees Celsius. Immediately the polyolefin separator melts away and the cathode and anode in the battery gets mixed up, which the researcher explains makes it prone to catch a fire.

LG’s patented separator, meanwhile, endures the heat and works normally in the battery, which the researcher explains is possible due to a 4- to 5-micrometer-thick coating layer that is less than a tenth of the thickness of a hair.

“This ceramic coating technology is what keeps batteries safe from explosion amid rising risks of being explosive due to battery density that is getting higher these days,” said Lee Je-an, a researcher at Battery R&D Center of LG Chem based in Daejeon Metropolitan City.

Established in 1979, LG Chem’s R&D Campus sprawls across a 300,000-square-meter land, being the largest private research institute in the state-run Daedeok Science Town. The campus is comprised of five centers: Corporate R&D, Basic Materials & Chemicals, Battery, IT & Electronics Materials and Life Sciences.

As the first ceramic coated SRS developer and patent holder, LG Chem continues to seek innovation in its battery R&D with a goal of developing thinner but longer-range battery cells that are desperately wanted by electronics and vehicle makers around the world.

The company announced on Sunday it will invest 1 trillion won ($895 million) in R&D this year, which accounts for 4 percent of last year’s sales and the firm’s biggest-ever.

“The investment will be made aggressively with a goal of raising 8.5 trillion won in sales of new products,” said Park Jin-soo, vice chairman and CEO of LG Chem. “About 30 percent of the new investment will go to the battery business and advanced materials for vehicles.”

|

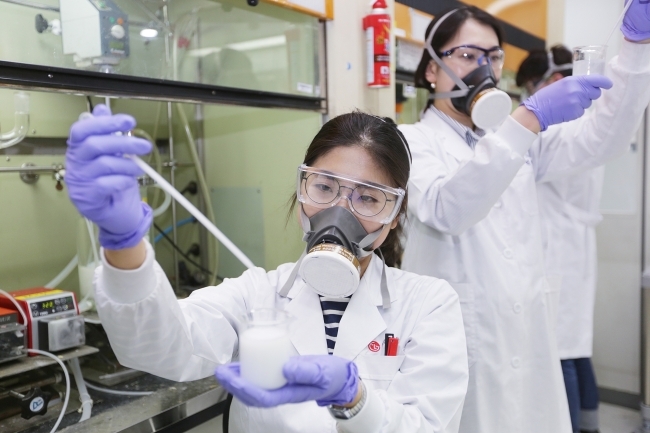

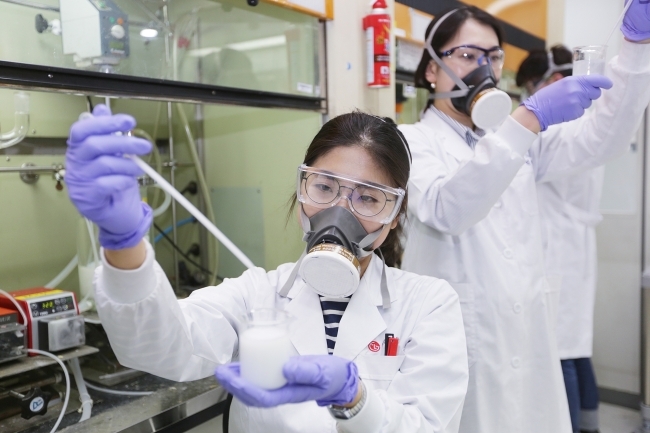

Researchers are at work at the Battery R&D Center in LG Chem R&D Campus Daejeon. (LG Chem) |

The LG affiliate will continue ramping up the R&D investment with a goal of reaching 1.4 trillion won by 2020.

LG Chem is the No.1 electric vehicle provider followed by Panasonic and Samsung SDI, according to market researcher Navigant. It supplies EV batteries for about 30 automakers including GM, Renault, Volvo and Audi.

However, the battery business has been posting deficits as of the final quarter of last year due to low demand for electric vehicles. The company’s China business was hit by the Chinese government’s subsidy cuts for foreign EV makers and the factory’s operating ratio hovered below 50 percent until early this year.

“China is the biggest and the most important market for us,” Park said. “So we are devising multiple strategies and tactics to recover the China business.”

Park said the plant’s operating ratio has been recently restored to 70 percent, and he expects it to normalize soon.

Other than China, Park is also looking at India where he sees high growth potential for electric vehicles.

The vice chairman also shrugged off concerns about the company’s US business amid rising expectations the Trump administration would ease regulations on ecofriendly vehicles.

“We believe that EV battery subsidies will phase out by around 2020, so the real competition may begin then,” he said. “Regulatory issues in each country will affect the battery business less and less in the course of time.”

LG Chem has been making constant investments in the US, Park highlighted, and will continue do so without elaboration.

By Song Su-hyun (

song@heraldcorp.com)

![[Weekender] Korea's traditional sauce culture gains global recognition](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg)