|

Jobseekers queue outside an employment center in Sintra, Portugal. (Bloomberg) |

LONDON (AP) ― Another month, another record unemployment rate for the economy of the 17 European Union countries that use the euro.

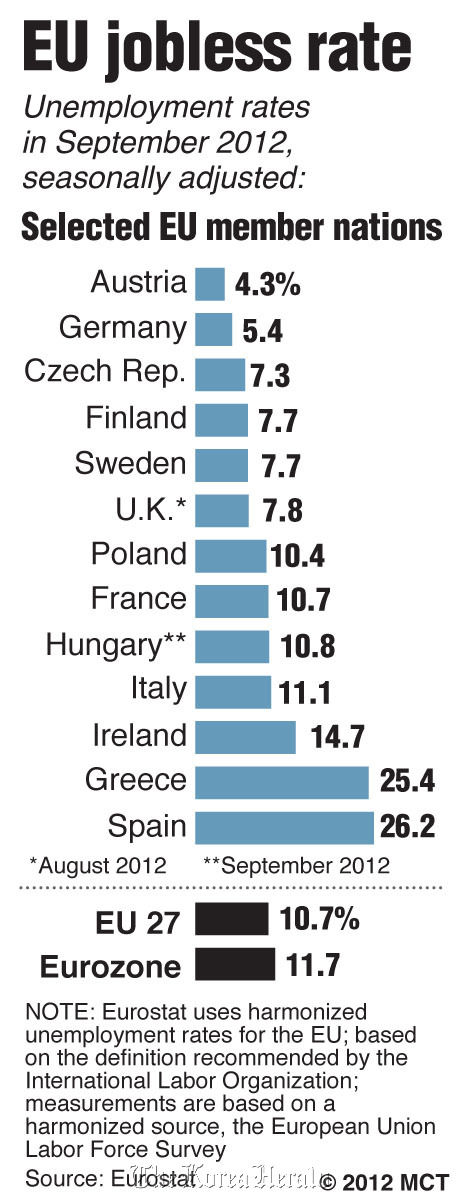

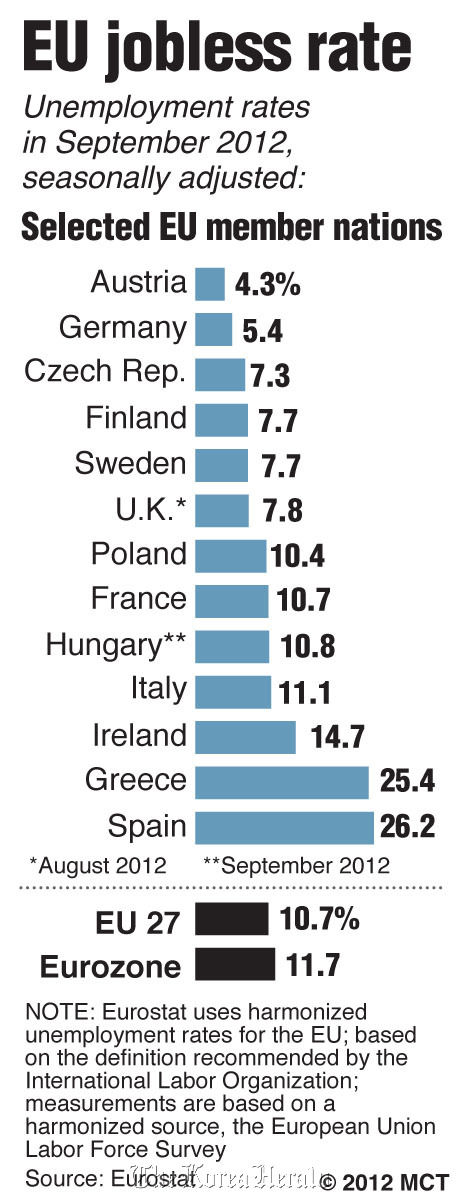

Figures released Friday by Eurostat, the EU’s statistics office, showed that the recession in the eurozone pushed unemployment up in the currency bloc to 11.7 percent in October, the highest level since the introduction of the euro in 1999.

The rise from September’s previous record of 11.6 percent was anticipated after the eurozone returned to recession in the third quarter, commonly defined as two consecutive quarters of negative growth.

While the eurozone’s unemployment has been inching upward since June 2011, the equivalent rate in the U.S. has fallen to below 8 percent as the world’s largest economy continues its recovery from recession. In October, it stood at 7.9 percent.

Eurostat found that 18.7 million people were out of work across the eurozone, an increase of 173,000 on the previous month and 2.2 million higher than the year before. The wider 27-nation EU that includes non-euro countries such as Britain and Poland had an unemployment rate of 10.7 percent in October and a total of 25.9 million out of work.

“The level of unemployment in Europe remains unacceptably high,” said Jonathan Todd, a spokesman for the European Commission, the EU’s executive arm.

Spain and Greece have the region’s highest unemployment rates ― both over 25 percent, with youth unemployment levels heading toward 60 percent, a figure that could have a long-term economic and political impact.

“Talk of a ‘lost generation’ of young people now looks like an alarming possibility,” said Andrea Broughton, principal research fellow at the Institute for Employment Studies.

Both countries are in recession and struggling to convince investors, as well as their own people, that they can control their economies. Both, along with a number of other European countries, have introduced tough austerity measures, such as cutting spending and raising taxes, in order to get a handle on their debts.

However, measures such as reducing wages and pensions hit the labor force in the pocket and lower demand in the economy.

Other measures taken alongside the austerity, such as reforming labor practices, boosting skills and education, are intended to promote jobs but they take time, both to enact and to feed through an economy.

“We expect, however, that progress in structural reforms, especially those that improve the functioning of labor markets, will help lower unemployment and facilitate new employment opportunities,” Mario Draghi, the president of the European Central Bank, said in a speech Friday in Paris.

Many economists think unemployment in many countries will carry on rising for months to come, certainly as long as the economies remain in recession. Draghi said Friday that he expects the recovery in the eurozone to start only in the second half of next year.

Marie Diron, a senior economic adviser at Ernst & Young, forecasts unemployment will rise through 2013 and peak at a little under 20 million in the last quarter of the year. She laid out the hope that by then, those companies that have become “leaner and fitter” could fuel growth and start hiring again.

“But before we reach that stage, there is unfortunately more pain to go through with high social costs,” Diron said.

The Commission’s Todd said all EU countries should implement a new scheme ― to be officially proposed next week ― to help unemployed under 25 year olds. The scheme would ensure that, within four months of leaving school or becoming unemployed, a young person would be offered a job, further education, a traineeship or an apprenticeship.

“This would extend to the whole of the EU existing good practice that exists in, for example, Austria, Finland and Sweden,” Todd said. All three countries have below-average unemployment rates, and Austria actually has the lowest in the eurozone at 4.3 percent.

At present, the five euro countries at the forefront of the debt crisis ― Greece, Spain, Italy, Cyprus and Portugal ― are in recession. Others could well join them in the months to come.

The currency bloc’s powerhouse economies, such as Germany and France, have also seen growth levels fall in the last year and that’s increased pressure on businesses to cut costs. Industrial conglomerate Siemens AG, for example, announced Friday it would cut another 4,700 jobs, though not all in Germany.

Germany’s unemployment rate in October was unchanged at’ 5.4 percent. France’s was steady too, albeit at nearly double Germany’s at 10.7 percent.

Separately, households got some good news in Eurostat figures showing the annual inflation rate in the eurozone fell by more than anticipated to a 23-month low of 2.2 percent in November from 2.5 percent the previous month.

Since it was a preliminary estimate, no reason for the fall was given but waning labor market pressures to lift wages are likely to have been, at least partially, behind the fall.

“We think inflation could fall quite a bit further over the next year or so in response to the spare capacity in the economy, helping to ease the squeeze on households’ real incomes,” said Jonathan Loynes, chief European economist at Capital Economics. “But whether that will get them spending in an environment of austerity and rising unemployment is another matter.”

Despite the November decline, inflation is still above the ECB’s target of keeping price rises at just below 2 percent. Few economists think the ECB will cut its main interest rate from the current record low of 0.75 percent at its monthly policy meeting next Thursday.