What’s new: 2Q16 earnings mostly in line with estimates

2Q16 earnings at SK Telecom (SKT) were mostly in line with our estimates and consensus. Sales missed our estimate by 1.4% as ARPU fell.

OP was 6.7% lower than our estimate on the sluggish sales and losses at subsidiaries, including SK Planet. ARPU fell 0.7% QoQ as the weighting of subscribers opting for rate discounts increased and the number of subscribers with a second device grew to 890,000, up 16.3% QoQ. OP fell 1.3% YoY, but given the early retirement costs in 2Q15, adjusted OP fell 22%.

Mobile (SKT separate) marketing fees edged down 2.5% YoY, but labor costs increased 7.3% YoY on more hirings. NP contracted 26.7% YoY on lower equity method gains from SK Hynix while contracting 49.3% QoQ as disposal gains from Loen shares were booked in 1Q16.

Pros: Commerce and media bolster growth outlook

We believe growth potential is high for the commerce and media businesses. SK Planet’s 11st expanded its business from simply connecting internet shopping malls (open markets) to a business that purchases, sells and delivers products.

And, the company is planning to increase commerce investments utilizing W400bn in cash and external funding. 11st has a competitive advantage as it can utilize its proprietary big data while generating synergies with Syrup (15mn subscribers), a service that connects on and offline orders, payments, and OK Cashbag (38mn customers)’s customer loyalty accounts. Meanwhile, SK Planet plans to cut costs by leasing a logistics warehouse, adopting selective direct purchasing and outsourcing deliveries to affiliates.

Going forward, transaction amounts should grow rapidly. Furthermore, SKT is pushing to grow IPTV subscribers after the CJ Hellovision deal was vetoed. IPTV should reach BEP in 2016 as subscribers should grow by 15.9% via joint telecom and broadcasting sales. And, SK Broadband’s earnings should improve with a turnaround in IPTV.

Cons: Losses continue on commerce expansion

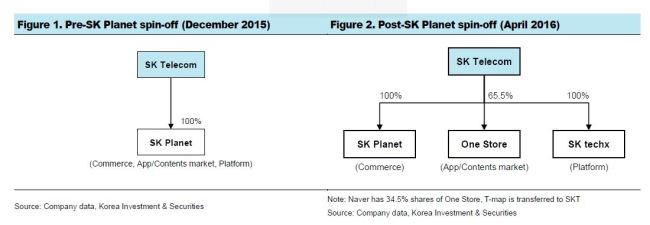

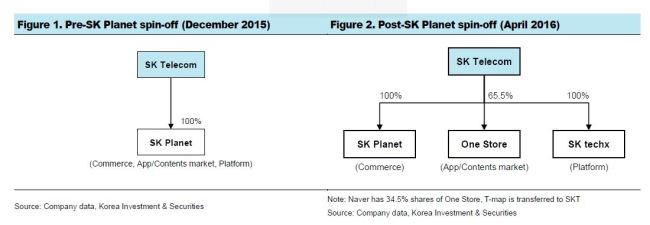

Losses continue at SK Planet due to the focus on internet shopping (e-commerce).

SK Planet is trying to become the leading internet shopping company this year and the third-largest retailer over the mid to long term.

We forecast internet shopping will turning profitable after 2018. As such, 2016-2017 consolidated earnings should lag separate earnings.

Conclusion: Maintain BUY and TP of W282,000

We maintain BUY with a TP of W282,000, which equates to the sum of fair values based on adjusted earnings, excluding SK Hynix, of W220,568 (13.8x PE) and SK Hynix’s per-share value of W61,608 (10% discount). Dividend yield reaches 4.4%, suggesting minimal share downside risk. SK Planet’s external funding and the upcoming IPO should catalyze a re-rating.

Source: Korea Investment & Securities