Bucking the trend of major global stock markets which saw some of their best gains in decades, South Korea’s main bourse Kospi remained flat on the last trading day of 2019, unable to pierce the 2,200 points mark.

For a decade now, many market watchers expected Kospi to surpass the 3,000 mark, after it topped 2,000 in 2009. Now as we enter a new year, all eyes are on whether it will gain new growth momentum.

According to experts, the main bourse is expected to gain vitality this year backed by a recovery in the global economy and a rebound of the semiconductor industry -- the country’s main growth vehicle -- but not dramatic enough to breach the mid-2,000 mark.

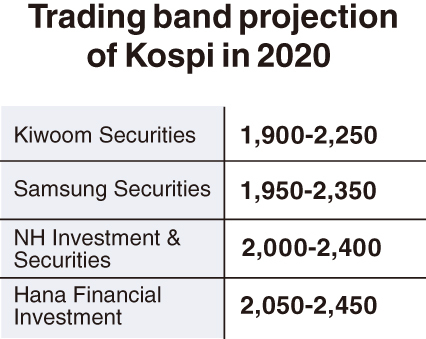

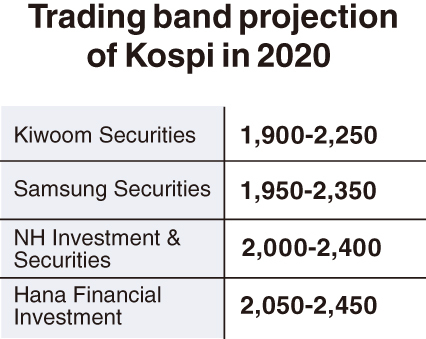

The Korea Herald survey of stock market outlook with research heads of four securities firms predicted the yearly band of the Kospi index to move in the 1,900-2,450 range.

Kiwoom Securities expects a trading band of 1,900-2,250, while Samsung Securities forecasts 1,950-2,350. NH Investment & Securities and Hana Financial Investment expect 2,000-2,400 and 2,050-2,450, respectively. The local stock market fluctuated within a trading band of 1,900-2,200 in 2019.

However, despite the overall positive outlook, all the four brokerages are of the view that the index could still fall below 2,000, if the US and China revive their trade tensions amid prolonged political uncertainties.

A partial “phase one” deal is expected to be signed soon to end their trade war -- that will increase US imports of agricultural goods to China, while Washington eases massive tariffs on Chinese products -- to be followed by “phase two” deal talks between President Donald Trump and President Xi Jinping.

However, it is uncertain whether they will resume their dispute given their yearslong war of words. This will impact the local semiconductor industry and other sectors, according to market experts.

“The unpredictable US-China trade relations will expand uncertainties in the Korean stock market,” said Kim Ji-san, the head of research center at Kiwoom Securities.

|

(Yonhap) |

NH Investment & Securities is of the view that the Korean stock market will rise in the first half of this year with the “falling triple bottom line performance” of Korean companies in the second half of the year. The results of the US presidential election are also expected to have a significant impact on the benchmark Kospi.

“Following the improvement in the global economy, large-cap stocks will be strong with export improvement in the first half. But some major events such as the upcoming US presidential election in November may deflate the index later,” said Lee Chang-mok, head researcher at NH Investment & Securities.

While all the brokerages said investors should pay greater attention to the US stock market in 2020, they considered the most promising industries this year in Korea will be information technology, semiconductor and media sectors.

Yun Sok-mo, research head at Samsung Securities, said semiconductor firms will be able to report about 20 percent growth in net profit this year. Along with Samsung Electronics, he picked Kakao as another promising stock, due to its improving business performance.

Hana Financial Investment head researcher Cho Yong-jun also paid attention to the semiconductor industry and IT-related stocks such as Kakao and Naver.

“Expanding infrastructure investments in major countries, 5G networks and internet data centers are positive factors that will benefit local semiconductor and IT firms. These industries will trigger a rebound of Kospi’s large-cap stocks,” he said.

By Jie Ye-eun (

yeeun@heraldcorp.com)