While emptying her desk on her last day at the office, Kim Young-sun, 46, recalls the day 18 years ago when she started working at a bank in Seoul.

She built her career mostly in retail finance, except for a brief assignment in corporate banking. Management began imposing a heavier workload on bankers in recent years while strictly assessing performance, she said.

The stress of that accompanied concerns about the faster-than-expected growth of the fintech industry and platform-based, nontraditional players taking away clients from retail banking. But it was the bank adopting so-called artificial intelligence bankers at branches as part of its transformation strategy that hit her the hardest.

“For years, the scenario of digitalization in finance slashing human jobs has existed. But I never thought I would quit this early,” she said.

“They see little vision or future in their careers ... that is the reason why I chose to retire early,” Kim added.

Kim is among many South Korean bankers at the peak of their careers who have been pushed to the wayside by the industry. In the face of digitalization, speed and efficiency have taken priority, minimizing the need for human service.

With the emergence of AI bankers, the number of retail bankers is expected to decline by 20 percent to 30 percent in 10 years, said Seo Jung-ho, a senior researcher at the Korea Institute of Finance.

In light of this, banks are already carrying out large-scale job cuts with voluntary retirement offers that target even staffers in their 40s. Their rationale is that quickly embracing digitalization requires lower staff numbers and more technology.

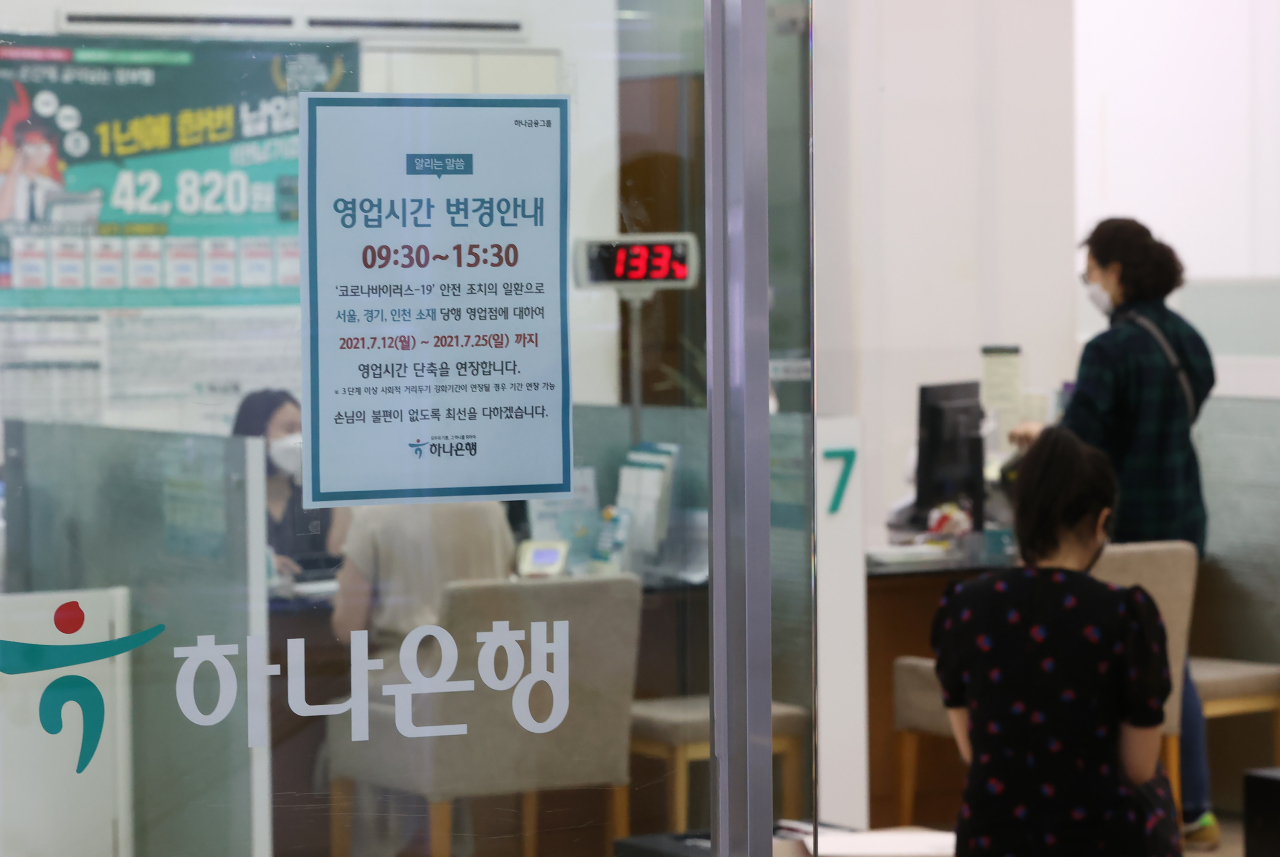

For instance, Hana Bank’s voluntary retirement program, which guarantees 24 months’ salary, is for those who have worked for over 15 years and were born before July 31, 1981.

Early retirees receive severance packages worth roughly 200 million won ($174,060) on average, according to income data from last year provided by the Financial Supervisory Service.

“We decided to make job cuts in a bid to efficiently reshuffle personnel and make room for staffers capable of fully coping with the rapidly changing finance settings such as digitalization,” a Hana Bank official said.

Shinhan Bank completed its second round of voluntary retirements in June. It expanded its net of eligible applicants this year, offering packages to those younger than 49 who had worked for the bank for more than 15 years. Those in the program were promised severance packages worth the equivalent of 36 months’ salary.

The bank’s income data from last year shows early retirees leaving with big checks worth up to 300 million won. According to a Shinhan Bank official, 133 people registered for early retirement.

Experts say the industry is embracing the transition much faster than they expected, largely due to the pandemic.

“Digitalization of financial services has been going on for years, but COVID-19 and the consequent need for non-face-to-face services brought such change faster than anyone had imagined,” said Hwang Se-woon, a senior researcher at the Korea Capital Market Institute.

With the exodus of bankers, the retirees are likely to look for other jobs.

According to a survey conducted by the Korea Financial Investment Association last year, 404 out of 550 people working in the finance industry wanted to get other jobs after retirement. Nearly 300 people wanted to work in finance again.

But experts say it would be difficult for them to continue working at internet banks or fintech companies.

“Of course the fintech industry is looking for talented workers. However, most of the job opportunities are related to digital technology, which they know almost nothing about. So they will have to start their own business or be self-employed,” Hwang said.

With no particular experience in digital finance and no vision for the new industry, Kim said she is fully aware that she might not get a new job in finance as the industry undergoes a massive transformation.

“Even though banks offer short-term contracts to retirees, they are temp jobs. And there are no fintech companies looking for senior bankers only with experience and without expertise in digital technology,” Kim said. “It is better to start a business -- like a coffee shop.”

By Byun Hye-jin (

hyejin2@heraldcorp.com)