Kakao is set to become the largest shareholder of its internet-only bank on Friday, marking it as the first nonfinancial services firm to have majority stake in a South Korean lender.

The Financial Services Commission on Wednesday approved Korea Investment Holdings’ request to transfer 15 percent and 29 percent of its current 50 percent stake in Kakao Bank to Kakao and Korea Investment Value Asset Management, respectively.

Korea Investment Value Asset Management is a second-tier subsidiary of Korea Investment Holdings, the holding entity of a major financial group here.

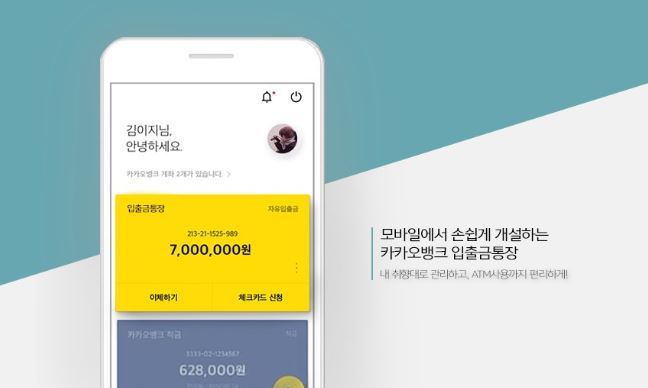

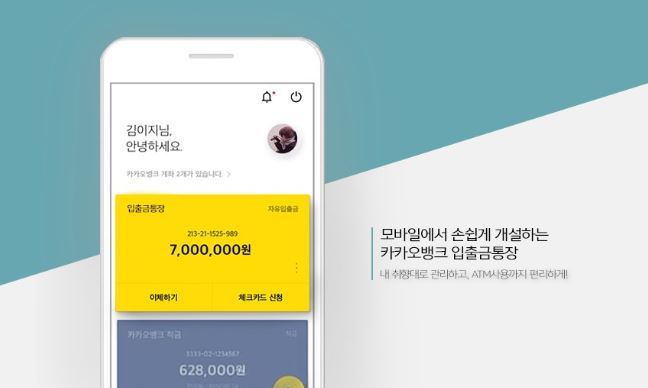

|

(Kakao Bank) |

The deals were valued at a combined 489.5 billion won ($419.3 million).

As of Friday, Kakao will own a 34 percent stake in the online-only bank. Korea Investment Value Asset Management will hold 29 percent stake, making it Kakao Bank’s second-largest shareholder. Meanwhile, Korea Investment Holdings’ stake in the internet-only bank will be reduced to 5 percent minus one share.

Kakao has faced major hurdles in its efforts to become the largest shareholder since April, when it first applied to the FSC for relevant reviews. Though the financial regulator commenced its reviews, it put them on hold citing allegations surrounding Kakao Chairman Kim Beom-su’s violations of fair trade regulations.

But the South Korean courts acquitted Kim of charges against him for failing to report on five Kakao subsidiaries in 2016 prompted the FSC to continue the reviews and green light the move.

Kakao has been seeking to increase its initial 10 percent stake in Kakao Bank after the National Assembly in September last year passed a bill that allows nonfinancial services companies to own larger stakes in internet-only banks above the previous 10 percent cap.

As Kakao Bank’s largest shareholder, Kakao is expected to create more synergies with the internet-only bank and its other businesses including its popular messenger app KakaoTalk and taxi-hailing service Kakao Taxi. Kakao Bank’s planned initial public offering for next year is also projected to gain momentum.

The FSC’s decision has turned the focus on Kakao Bank’s internet-only bank rival and currently cash-strapped K bank’s situation.

The nation’s major telecom operator, KT, has been seeking to mirror Kakao’s moves, by raising its current 10 percent stake in K bank to 34 percent. KT remains K bank’s second-largest shareholder.

Though K bank wants to secure capital -- as it reported a net loss of 63.5 billion won during the first nine months of this year and even stopped providing loan services since April -- the FSC has yet to approve KT’s request, which was already denied once earlier. It was denied after the telecom carrier was charged with price collusion in April.

At the moment, Kakao Bank and K bank are the only internet-only banks operating in South Korea.

Three consortia are currently competing for a license to set up a third-internet only bank, with the financial authorities reviewing their applications. One consortium, is led by fintech firm Viva Republica, operator of mobile financial app Toss. It includes KEB Hana Bank, Hanwha Investment & Securities and Standard Chartered Bank Korea.

The second consortium is led by an industry organization of owners of small businesses in Seoul, while the third consists of five individuals. (

mkjung@heraldcorp.com)

![[Weekender] Korea's traditional sauce culture gains global recognition](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg)