|

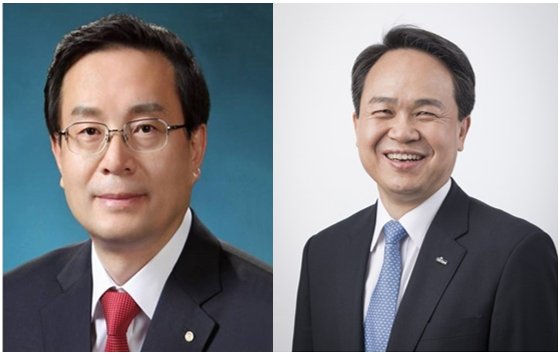

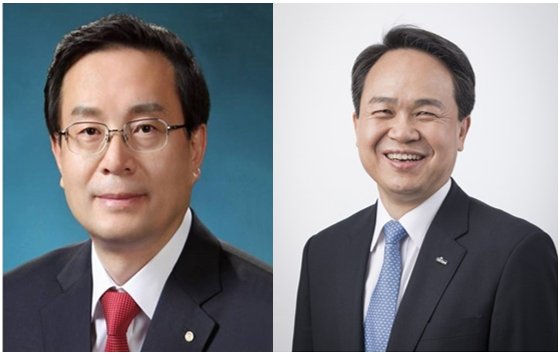

(From left) Woori Financial Group Chairman Sohn Tae-seung and Shinhan Bank CEO Jin Ok-dong |

South Korea’s market watchdog has informed top executives at Woori Financial Group and Shinhan Bank they may be punished over a financial fraud scandal involving Lime Asset Management, Financial Supervisory Service officials and industry sources said Thursday.

Sohn Tae-seung, the incumbent Woori Financial Group Chairman and former chief executive of Woori Bank, was informed that he may be suspended from his duties, which is the second-heaviest reproach in the regulator’s five-level punishment scale, FSS officials said.

The authority also notified that Jin Ok-dong, head of Shinhan Bank, may also receive a reprimand warning, which restricts executives from getting new jobs in the finance sector for the next three to five years, although it does not strip them of their current positions.

Under the current regulations, once receiving a reprimand warning or higher punishment, companies are barred from acquiring other firms for a year, casting a cloud over the two banks’ merger and acquisition plans ahead.

The reprimand proposal is subject to a decision by the regulator’s in-house committee on Feb. 25.

“The institutions that received prior notices of disciplinary actions have an opportunity to clarify their position to authorities through the FSS’ disciplinary committee to ease their penalties. The sanctions on the heads of Shinhan Bank and Woori Bank aim to urge the top executives’ responsible attitudes regarding management risks,” an FSS official said.

Both Woori and Shinhan said they are preparing for the committee meeting.

Even if the committee approves the proposal, two top executives are likely file an administrative suit for cancellation of the regulator’s decision, according to watchers.

In March last year, Woori’s Sohn had filed an injunction to nullify the watchdog’s punitive measures against him over improper selling of derivatives-linked fund products. The court accepted his injunction request and Sohn gained approval for his second term during its general shareholders’ meeting held in the same month.

Should the FSS’ punitive action be imposed, Sohn is likely to seek a court injunction again this time, and so would the head of Shinhan Bank CEO Jin Ok-dong, who won the second term late last year, in a bid to remove hurdles for pursuing another term, they added.

Lime Asset, founded in 2012, has been under an FSS investigation since July 2019 for having concealed massive losses and inflated investment returns to maintain its customer base. It suspended fund redemption worth an estimated 1.6 trillion won ($1.4 billion). The troubled hedge fund operator admitted last year that the total investor losses of its four troubled funds could reach more than 1 trillion won.

Woori Bank reportedly sold the largest amount of the troubled funds estimated at 357.7 billion won, while Shinhan Bank sold 276.9 billion won.

This is the first time in seven years for the supervisory agency to hand down suspension of duties order to a banking group’s chief since 2014.

It suspended the former KB Financial Chairman Lim Young-rok from his duties for mishandling an internal feud over the group’s selection of a new computer system.

By Choi Jae-hee (

cjh@heraldcorp.com)