KB Financial Group’s plan to diversify business appears to have hit a snag as its push to take over ING Life’s Korean arm ended up a damp squib.

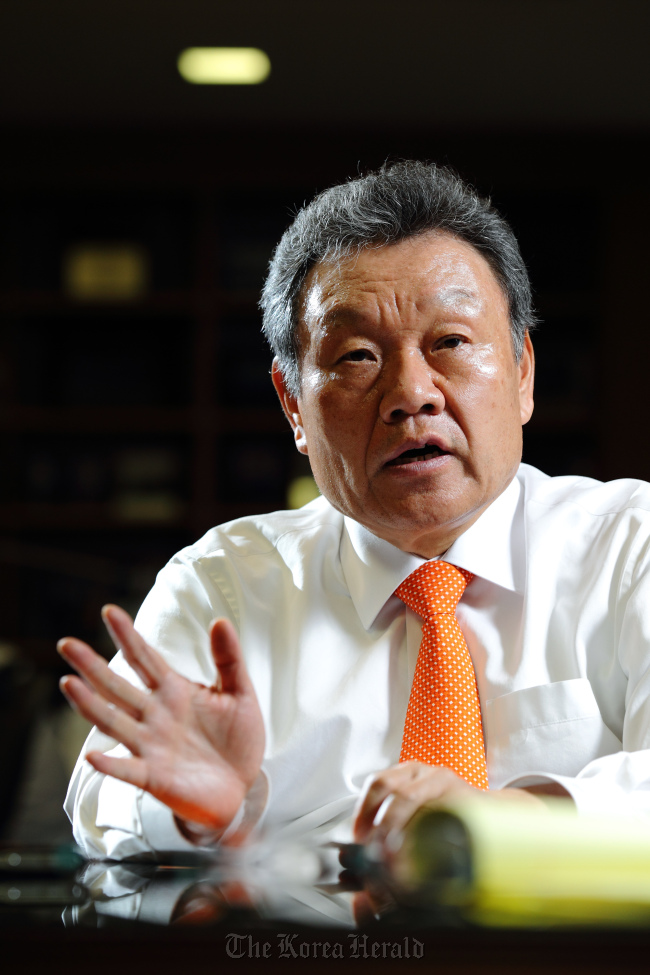

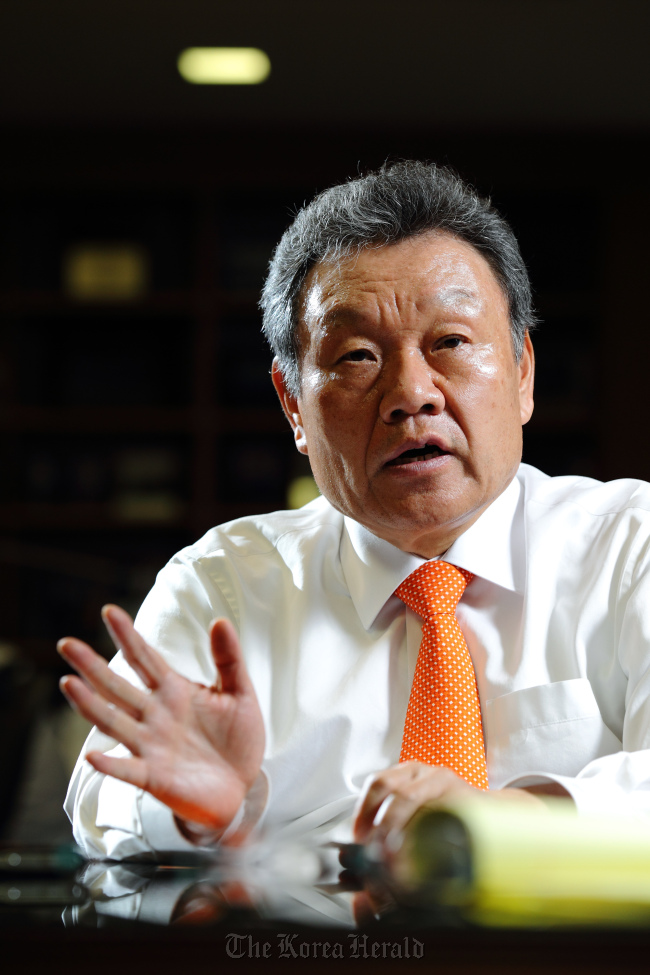

KB Financial Group chairman Euh Yoon-dae has sought to bolster its non-banking business to grow into what he called a “mega bank” that could compete with global banks.

But the apparent blow to Euh that left a blot on his career is expected to negatively affect the nation’s No. 2 financial group’s future course in regard to its endeavors for mergers and acquisitions, banking sources said.

On Tuesday, KB Financial’s board rejected the plan to buy the ING unit, stressing that now is the time to save up capital as the economic slump at home and abroad is expected to continue.

|

Chairman Euh Yoon-dae |

The takeover plan fell through allegedly due to negative views by some outside directors and financial authorities. Some said a recent fit of anger by Euh in Beijing might have affected the vote.

The outburst indicated growing conflict between KB Financial management led by Euh and outside directors led by Lee Kyung-jae, chairperson of the board of directors, over the takeover plan.

Euh, widely known as an “MB’s man” for his close personal ties to President Lee Myung-bak, has led the nation’s leading financial group since 2010.

KB Financial’s board of directors failed to reach a conclusion during a meeting on Dec. 5, and resumed the meeting on Tuesday, a day before Koreans elected a successor to replace Lee. Five voted for the takeover, five against, and two abstained.

The top management had persuaded the board directors by lowering the acquisition price from 2.7 trillion won ($2.5 billion) to nearly 2.4 trillion won, but the directors were still wary of the risks of an M&A, pointing to the bleak outlooks for the banking and life insurance industries.

The nation’s financial authorities also signaled skepticism over the bid.

Some industry observers say the authorities and politicians may have put the brakes on the ING Life takeover so KB can later have enough money to buy a controlling stake in Woori Financial Group. The government has been seeking to privatize Woori to retrieve the public funds it poured in for the bank’s bailout.

Since the beginning of his term, Euh has emphasized the need to diversify KB Financial’s business portfolio through mergers and acquisitions and to strengthen its non-banking business.

KB Kookmin Bank holds 77.39 percent (289 trillion won) of KB Financial Group’s assets, and most of the group’s profits come from the bank too. Euh has stressed that the group’s non-banking business should account for 30 percent of its assets.

As concerns were growing that the bank might lose its leading status, calls for a stronger non-banking business had gained weight.

But none of the M&A deals that Euh showed interest in panned out well.

The group once eyed Tongyang Life Insurance, but soon gave up amid concerns that a merger with an insurer of similar business structure to KB Life would undermine efficiency. So he began sizing up ING Life Korea.

“External business environment and insurance industry prospects worsened compared to when the ING takeover was first brought up. The presidential election also neared,” said a KB Financial official.

“Outside directors appear to have felt it risky to approve of the acquisition under such circumstances.”

As for the sale of Woori Financial attempted in July, KB Financial couldn’t even submit its letter of intention due to fierce opposition from politicians and the financial trade union.

KB was only left with Cheil Savings Bank (now KB Savings Bank) which the financial authorities pushed onto KB.

By Kim So-hyun (

sophie@heraldcorp.com)

![[Weekender] Korea's traditional sauce culture gains global recognition](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg)