South Korea is seeking to expand the use of the won in trade with China as part of its efforts to internationalize its currency by reducing heavy reliance on the dollar and better cope with risks from external turbulence, the finance minister said.

To that end, the government will tap into the Korea-China currency swap line, through which it lends money to Chinese firms and encourages them to settle payments for trade by using the won, he added.

This is the first meaningful action by the government to encourage the use of its currency beyond its borders after putting the efforts on hold in the face of the 2007-08 financial crisis.

|

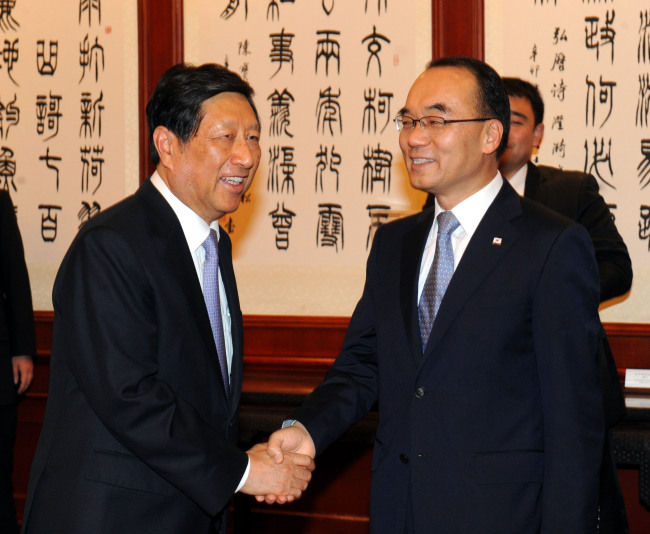

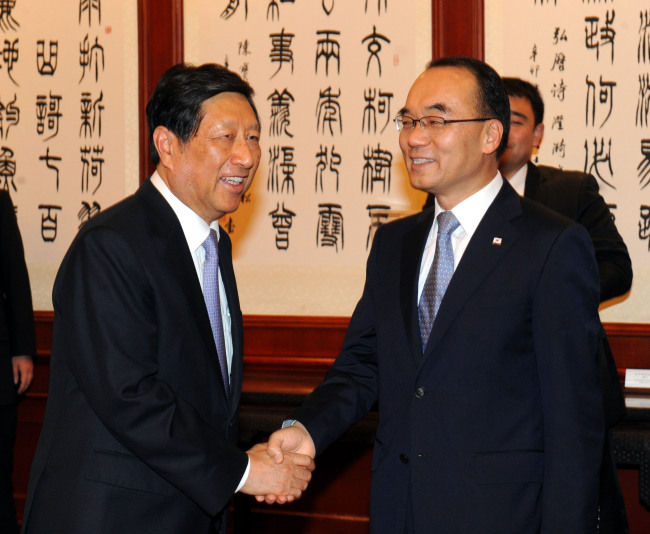

South Korea’s Finance Minister Bahk Jae-wan (right) shakes hands with China’s National Development and Reform Commission Chairman Zhang Ping ahead of the 11th bilateral meeting between economic policymakers of the two countries in Beijing, China, Friday. (Yonhap News) |

“We had pushed to internationalize the won, considering our heavy dependence on foreign currencies and susceptibility to a crisis, but the efforts were put on an indefinite hold since 2008,” Finance Minister Bahk Jae-wan told Yonhap News Agency in a recent interview.

“My thought is that we cannot delay the plan forever at a time when economic crisis situations have become a constant factor. We have decided to start first on a short-term basis, and are now reviewing measures actively,” he added.

Bahk said the government is considering tapping into the Korea-China currency swap line as a possible option through which it lends its money and encourages Chinese companies to use the won in settling payments for their imports from Korea.

In October last year, the two agreed to expand the currency swap deal from 180 billion yuan to 360 billion yuan in order to secure foreign exchange liquidity amid growing economic uncertainty. Under the three-year deal, both can trade one country’s local currency for the other’s.

China is Korea’s largest trading partner with bilateral trade expected to reach $300 billion by 2015.

Bahk expects that the plan to utilize the swap line will make it easier for Chinese firms to secure the won and eventually result in an increase in their use of the Korean currency in trade settlements. It will also have a “win-win” effect by encouraging Korean firms to settle transactions by using the yuan.

“We recently launched working-level discussions in July with Chinese counterparts on how to capitalize on the currency swap line,” he said. “Sooner or later, Chinese officials will come to Korea for a second round of talks,” he added.

Besides seeking to expand the use of the won in trade, Bahk added that the government will plan to allow the won to be used in capital transactions in some special cases.

For example, the government is considering allowing investment by a Chinese company in the stock market here if it uses money paid in won for its exports to Korea.

The move comes after Seoul sought to encourage the use of its local currency beyond its borders until recent years, a move aimed at reducing its dependency on the dollar so as to better defend itself from fluctuations of external market conditions.

The efforts, however, came to a standstill after the financial crisis in 2007-08 hit the global economy. South Korea put off the “currency internationalization” plan indefinitely as it struggled to rebound from the external shock-triggered chaos.

(Yonhap News)

![[Weekender] Korea's traditional sauce culture gains global recognition](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050153_0.jpg)