|

A captured image of an Instagram post by Kim Ji-hye (Instagram) |

Despite digital progress and surging online transactions, a notable consumption trend is emerging among South Koreans in their 20s and 30s, as an increasing number of them are opting to use physical cash over credit card transactions in their daily lives.

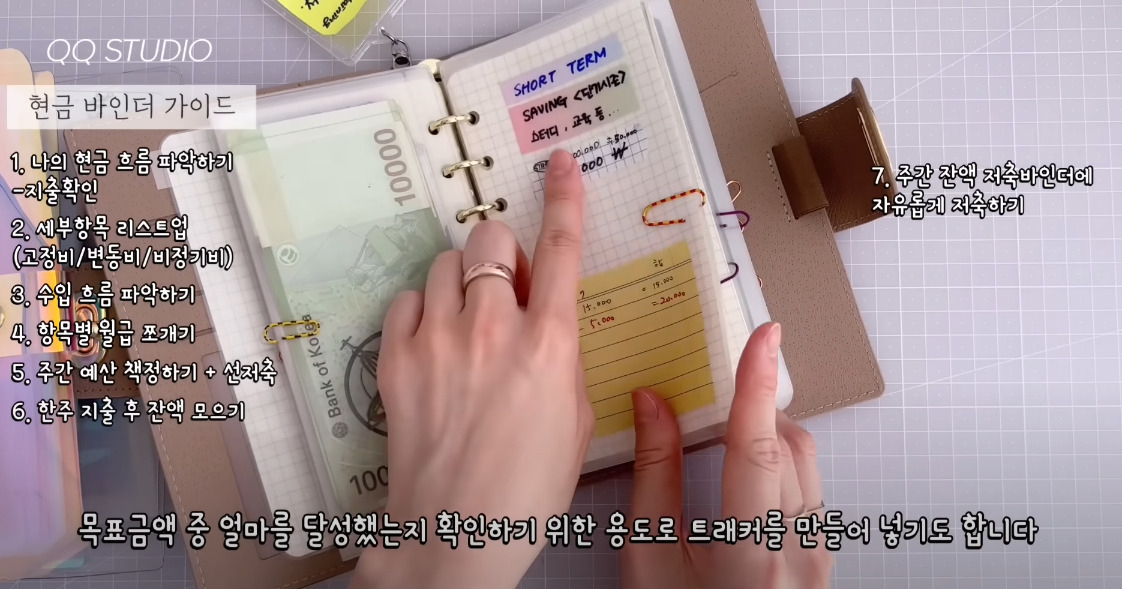

Referred to as "cash stuffing," the budgeting method involves withdrawing cash from a bank account and segregating it into designated envelopes for different categories, such as groceries, travel, dining out and more.

Gaining popularity among young those seeking to curb overspending and counter the "cashless effect" — a tendency to make more purchases when payments are less tangible — the method restricts spending to allocated amounts in a physically tangible way.

"I would spend about 1 million won ($770) solely on food delivery apps, but after switching to cash payments, the expenditure fell almost 70 percent,” 32-year-old Kim Ji-hye told The Korea Herald.

“Previously, most of my earnings would go to paying my credit card bills, but since starting cash stuffing, my savings went from zero to 1.2 million won every month,” said Yang Eun-bi, a 33-year-old professional web designer.

Meanwhile, some, like 24-year-old Kang, have gone to the extent of physically cutting their credit cards in half as a symbol of their commitment.

However, given the surge in the number of shops going cashless these days, a question arises: "Is it even possible?"

According to Choi Su-ji, a YouTuber who regularly publishes videos on her budgeting efforts, it is precisely the inconvenience that helps tackle unnecessary expenditures.

"You have to call employees every time you need to place an order at a shop. Given the inconvenience, I gradually shifted to cooking at home."

She added that, previously, her expenses largely came from food delivery apps.

"But, with cash, it is hard to count on delivery staff having exact change, so I would travel to the shops to pick up the food. This extra travel I have to make made me think twice before spending."

Moreover, amid soaring inflation and stubbornly high inflation rates, economizing has no longer become just a choice for many young Koreans. This trend comes as one of many in a string of various belt-tightening measures adopted by struggling young people in Korea.

For example, the no-spend challenge, which emerged last year, saw many skipping meals or surviving solely on food from the refrigerator at home.

More recently, young people began to scrutinize each other's spending habits in public chat rooms called "geojibang." or beggars' rooms, on KakaoTalk. In one such online community birthed this year, participants would refer to themselves as beggars and share their lists of expenditures -- along with harsh words of encouragement to promote stricter saving.

|

An infamous screenshot from an anonymous "beggars' room" shows participants chanting “We are beggars!” to acknowledge their lack of finances. (Instiz) |

The cash envelope system is largely viewed as the latest evolution from the two predecessors. However, some like Choi hold different views.

“This challenge is not about starving or promoting frugality at the expense of your leisure. Rather, it is about teaching you how to efficiently manage your finances and stay on top of your spending by requiring you to plan your expenses in advance,” explained Choi.

|

A captured image from a YouTube video by Choi Su-ji (YouTube) |

Saving as fun, creative outlet

Tech-savvy young people have also been sharing their cash-stuffing stories on social media, transforming it into a game or challenge.

As of Wednesday, a search for the hashtag of “cash challenge” on Instagram returned over 360,000 posts, along with numerous short-form videos in circulation.

According to cash challengers, this budgeting technique also holds unique visual and auditory appeal, making saving entertaining and providing another source of motivation.

“The sound of counting cash and hitting calculator buttons when budgeting is audibly soothing, ” Yang explained. "It is almost like ASMR."

Others also underscore the visual pleasure of decorating budget binders and cash envelopes, which conveniently also makes for Instagrammable photos.

|

A captured image from Instagram shows search results for the hashtag for "cash challenge," Wednesday. (Instagram) |

Some with artistic talent have also tried their hands at designing their personally customized envelopes and "accidentally" generated an alternative source of income in the process.

“I first started off wanting to have unique envelopes that are hard to find at shops. But after sharing the photos of them on Instagram, I started getting positive responses, and eventually decided to sell them,” said Kim, who opened an online store in November.