Intel’s plan to reenter the foundry business could be an indication of reshoring chip manufacturing back to the US, a key strategic move that would have ramifications on the local economy, which depends largely on chip sales.

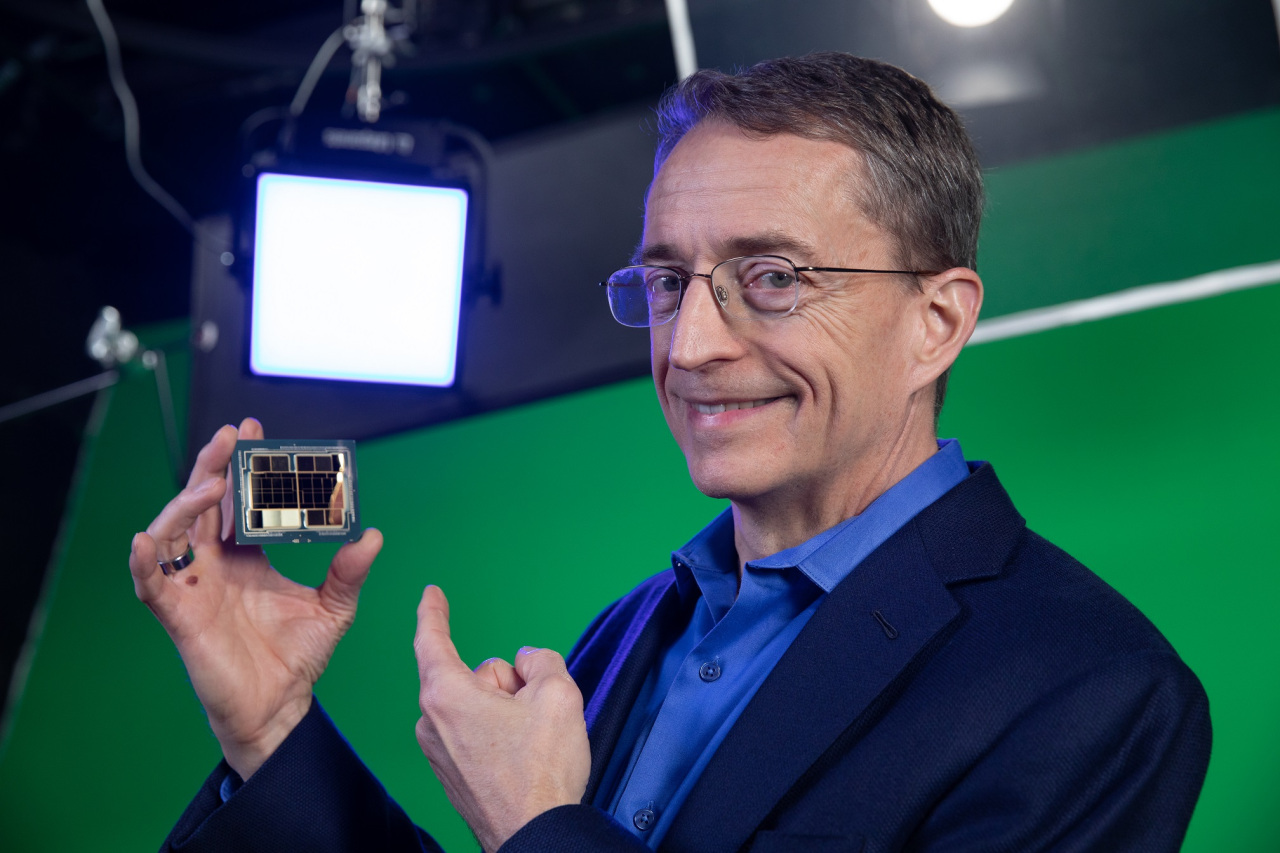

After announcing the plan to spend $20 billion on building two new fabrication plants in Arizona, Intel CEO Pat Gelsinger told BBC, “Having 80 percent of all supply in Asia simply isn’t a palatable manner for the world to have its view of the most critical technology.”

“Every aspect of humanity is becoming more digital, and when it becomes digital, it runs on semiconductors. And the world needs a more balanced supply chain to accomplish that. We’re stepping in,” he said.

Intel is not seen as acting alone, but backed by the US government, which is aiming at reinforcing its supply chains for key industries amid the ongoing global chip shortage that has caused problems in the American automobile industry.

“The US government, since the Obama administration, has been emphasizing ‘made in America’ a lot, and it is high time that US companies started to respond to the government’s policy,” said Kim Yang-paeng, a senior researcher at the Korea Institute for Industrial Economics and Trade. “It is significant, because, from now on, not just Intel, but more and more companies would join the move to restore the US status in the chipmaking industry.”

Before Taiwan’s TSMC was established in 1987, the US accounted for around 40 percent of global chip manufacturing. As the US started falling behind Japan’s DRAM technology in the 1980s, most of the global chip production shifted to Asia. Now only about 10 percent of the world’s total chip production takes place in the US.

“Although the investment size is not significant enough to bring a major change to the foundry industry, the fact that the US fabless company will restore its reputation as an integrated device manufacturer is more important,” Kim said.

It is also part of the Biden administration’s policy to review key supply chains, with the ultimate goal to further reduce US dependence on China.

A report by KIET released Thursday said the Biden administration’s reviews of supply chains for semiconductors could heighten competition for new investments in the US.

“The US is kick-starting its engine for reshaping orders in the global semiconductor industry,” the report said. “Korea needs new strategies in line with the changing order.”

The US would start taking substantial measures after the 100-day review period, the report said.

“The scope and degree of upcoming measures would have inevitable impact on the Korean chip industry,” it said. “One of the most likely measures is to induce foreign companies to invest more in the US to build high-tech chip plants to raise competitiveness of domestic supply chains.”

Currently, the US relies heavily on Taiwan and China, importing 73 percent and 7 percent of foundry chips from the respective countries, according to the report.

Some industry observers said Intel’s plan would pose a threat to Asian chipmakers Samsung Electronics and TSMC. But not all agreed.

“The US has demand for four more new chip plants, and by having Intel, the burden on Samsung and TSMC is to be reduced in terms of addressing the current chip shortage problems,” said Ahn Ki-hyun, senior executive director at the Korea Semiconductor Industry Association.

Intel’s move would be related to geopolitical tensions between the US and China rather than technological issues, the official said.

This is partly driven by concerns that Beijing aims to reunify mainland China with Taiwan, whom it regards as a renegade province, while North Korea continues to pose threats to South Korea.

“Intel’s foundry technology is two generations behind Samsung’s and TSMC’s. Intel would be starting to produce chips on 7-nanometer from 2024, but Samsung and TSMC would be doing 3 nm process by then,” Ahn said. “Now that the US is moving to manufacture its own chips, the world would see chip production in China decline gradually from the current 30 percent level, which is rebalancing of supply and demand.”

The KIET report also said the US efforts could benefit Korean chipmakers, which could help raise Samsung’s share in the foundry market, as it moves to turn away from China and Taiwan by reducing imports from TSMC.

By Song Su-hyun (

song@heraldcorp.com)